Increases to CEO Compensation Might Be Put On Hold For Now at Poddar Pigments Limited (NSE:PODDARMENT)

Key Insights

- Poddar Pigments to hold its Annual General Meeting on 23rd of September

- Total pay for CEO Shiv Poddar includes ₹12.0m salary

- The total compensation is 189% higher than the average for the industry

- Over the past three years, Poddar Pigments' EPS grew by 3.3% and over the past three years, the total shareholder return was 17%

Performance at Poddar Pigments Limited (NSE:PODDARMENT) has been reasonably good and CEO Shiv Poddar has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 23rd of September. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Poddar Pigments

Comparing Poddar Pigments Limited's CEO Compensation With The Industry

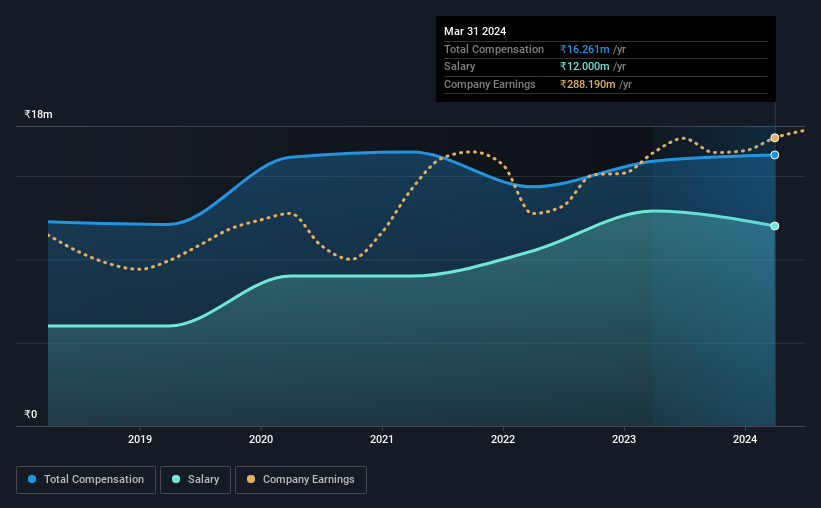

According to our data, Poddar Pigments Limited has a market capitalization of ₹4.3b, and paid its CEO total annual compensation worth ₹16m over the year to March 2024. That is, the compensation was roughly the same as last year. In particular, the salary of ₹12.0m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Indian Chemicals industry with market capitalizations under ₹17b, the reported median total CEO compensation was ₹5.6m. Accordingly, our analysis reveals that Poddar Pigments Limited pays Shiv Poddar north of the industry median. Furthermore, Shiv Poddar directly owns ₹215m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹12m | ₹13m | 74% |

| Other | ₹4.3m | ₹3.0m | 26% |

| Total Compensation | ₹16m | ₹16m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. It's interesting to note that Poddar Pigments allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Poddar Pigments Limited's Growth Numbers

Poddar Pigments Limited has seen its earnings per share (EPS) increase by 3.3% a year over the past three years. In the last year, its revenue is up 7.2%.

We're not particularly impressed by the revenue growth, but the modest improvement in EPS is good. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Poddar Pigments Limited Been A Good Investment?

Poddar Pigments Limited has served shareholders reasonably well, with a total return of 17% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Poddar Pigments that you should be aware of before investing.

Important note: Poddar Pigments is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PODDARMENT

Poddar Pigments

Manufactures and sells color and additive masterbatches for dope dyeing of man-made fibers and various plastic applications primarily in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)