Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Oriental Carbon & Chemicals Limited (NSE:OCCL) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Oriental Carbon & Chemicals

How Much Debt Does Oriental Carbon & Chemicals Carry?

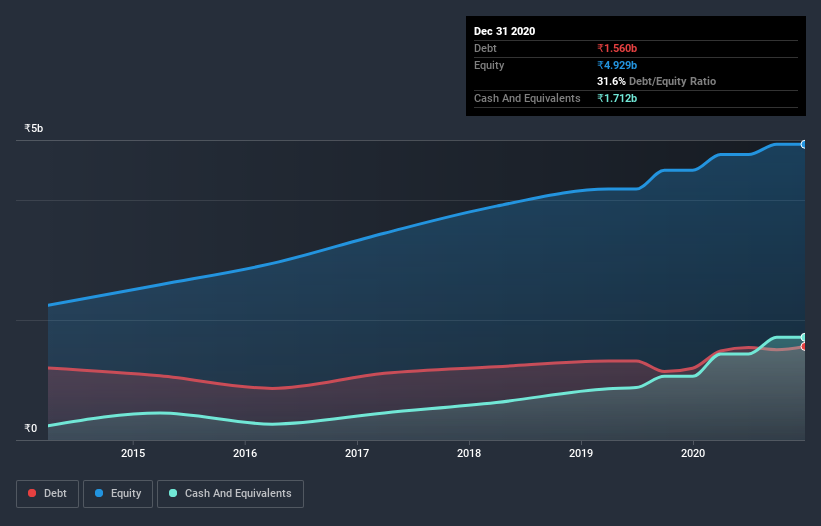

As you can see below, at the end of September 2020, Oriental Carbon & Chemicals had ₹1.50b of debt, up from ₹1.20b a year ago. Click the image for more detail. But on the other hand it also has ₹1.71b in cash, leading to a ₹208.1m net cash position.

A Look At Oriental Carbon & Chemicals' Liabilities

The latest balance sheet data shows that Oriental Carbon & Chemicals had liabilities of ₹1.23b due within a year, and liabilities of ₹1.29b falling due after that. Offsetting these obligations, it had cash of ₹1.71b as well as receivables valued at ₹709.5m due within 12 months. So it has liabilities totalling ₹99.7m more than its cash and near-term receivables, combined.

Having regard to Oriental Carbon & Chemicals' size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the ₹9.60b company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, Oriental Carbon & Chemicals boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Oriental Carbon & Chemicals saw its EBIT drop by 2.5% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Oriental Carbon & Chemicals will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Oriental Carbon & Chemicals has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, Oriental Carbon & Chemicals recorded free cash flow worth 59% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Oriental Carbon & Chemicals has ₹208.1m in net cash. So we don't have any problem with Oriental Carbon & Chemicals's use of debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Oriental Carbon & Chemicals you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Oriental Carbon & Chemicals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:OCCL

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives