- India

- /

- Metals and Mining

- /

- NSEI:MIDHANI

Why We're Not Concerned Yet About Mishra Dhatu Nigam Limited's (NSE:MIDHANI) 26% Share Price Plunge

The Mishra Dhatu Nigam Limited (NSE:MIDHANI) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

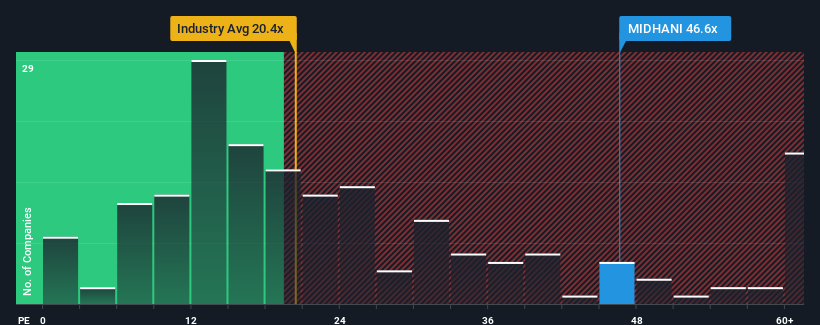

Even after such a large drop in price, Mishra Dhatu Nigam's price-to-earnings (or "P/E") ratio of 46.6x might still make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 26x and even P/E's below 15x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Mishra Dhatu Nigam hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Mishra Dhatu Nigam

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Mishra Dhatu Nigam's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 9.8% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 41% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 84% as estimated by the dual analysts watching the company. With the market only predicted to deliver 26%, the company is positioned for a stronger earnings result.

With this information, we can see why Mishra Dhatu Nigam is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate Mishra Dhatu Nigam's very lofty P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Mishra Dhatu Nigam maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Mishra Dhatu Nigam with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MIDHANI

Mishra Dhatu Nigam

Manufactures and sells super alloys, titanium, special purpose steel, and other special metals in India and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)