- India

- /

- Metals and Mining

- /

- NSEI:MIDHANI

Mishra Dhatu Nigam's (NSE:MIDHANI) Shareholders Will Receive A Smaller Dividend Than Last Year

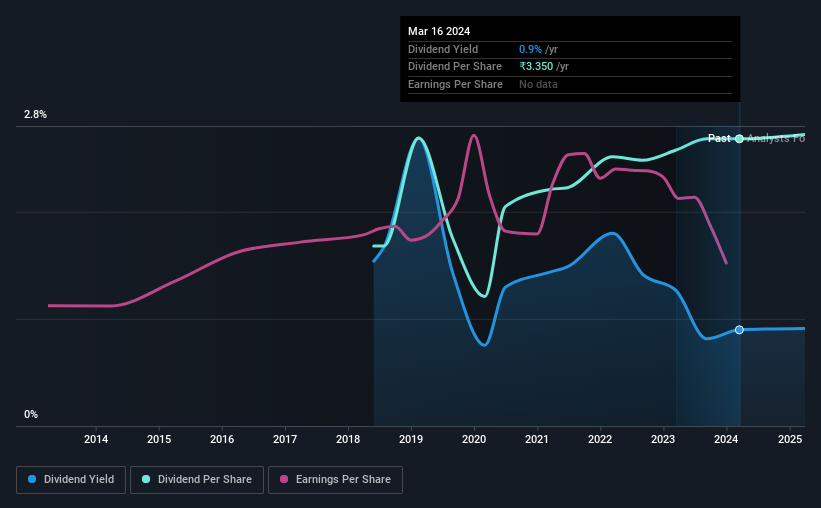

Mishra Dhatu Nigam Limited's (NSE:MIDHANI) dividend is being reduced by 16% to ₹1.41 per share on 13th of April, in comparison to last year's comparable payment of ₹1.68. Based on this payment, the dividend yield will be 0.9%, which is lower than the average for the industry.

Check out our latest analysis for Mishra Dhatu Nigam

Mishra Dhatu Nigam's Earnings Easily Cover The Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Based on the last payment, Mishra Dhatu Nigam was earning enough to cover the dividend, but free cash flows weren't positive. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

The next year is set to see EPS grow by 28.5%. If the dividend continues along recent trends, we estimate the payout ratio will be 42%, which is in the range that makes us comfortable with the sustainability of the dividend.

Mishra Dhatu Nigam's Dividend Has Lacked Consistency

Looking back, Mishra Dhatu Nigam's dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. Since 2018, the annual payment back then was ₹2.10, compared to the most recent full-year payment of ₹3.35. This means that it has been growing its distributions at 8.1% per annum over that time. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though Mishra Dhatu Nigam's EPS has declined at around 2.6% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Mishra Dhatu Nigam's Dividend Doesn't Look Sustainable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 3 warning signs for Mishra Dhatu Nigam that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MIDHANI

Mishra Dhatu Nigam

Manufactures and sells super alloys, titanium, special purpose steel, and other special metals in India and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)