- India

- /

- Basic Materials

- /

- NSEI:MANGLMCEM

Is Now The Time To Put Mangalam Cement (NSE:MANGLMCEM) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Mangalam Cement (NSE:MANGLMCEM). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Mangalam Cement

How Fast Is Mangalam Cement Growing Its Earnings Per Share?

In the last three years Mangalam Cement's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Mangalam Cement's EPS soared from ₹23.32 to ₹33.00, over the last year. That's a impressive gain of 42%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Mangalam Cement's EBIT margins have actually improved by 4.0 percentage points in the last year, to reach 14%, but, on the flip side, revenue was down 5.0%. That's not ideal.

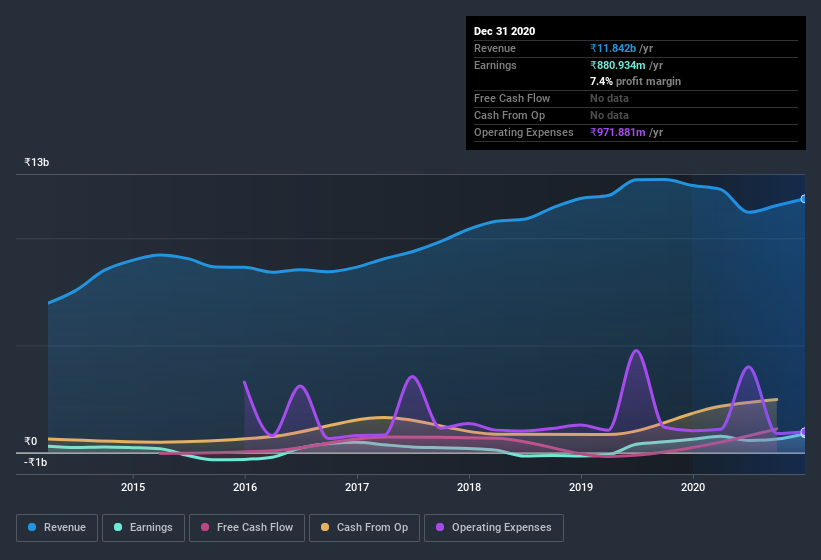

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Mangalam Cement isn't a huge company, given its market capitalization of ₹7.6b. That makes it extra important to check on its balance sheet strength.

Are Mangalam Cement Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Mangalam Cement insiders refrain from selling stock during the year, but they also spent ₹14m buying it. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Executive Co-Chairperson, Anshuman Jalan, who made the biggest single acquisition, paying ₹5.3m for shares at about ₹178 each.

On top of the insider buying, it's good to see that Mangalam Cement insiders have a valuable investment in the business. To be specific, they have ₹1.3b worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 17% of the company; visible skin in the game.

Is Mangalam Cement Worth Keeping An Eye On?

You can't deny that Mangalam Cement has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Even so, be aware that Mangalam Cement is showing 2 warning signs in our investment analysis , you should know about...

The good news is that Mangalam Cement is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Mangalam Cement or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:MANGLMCEM

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026