Here's Why We Think Krishana Phoschem (NSE:KRISHANA) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Krishana Phoschem (NSE:KRISHANA), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Krishana Phoschem with the means to add long-term value to shareholders.

How Quickly Is Krishana Phoschem Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that Krishana Phoschem has grown EPS by 39% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

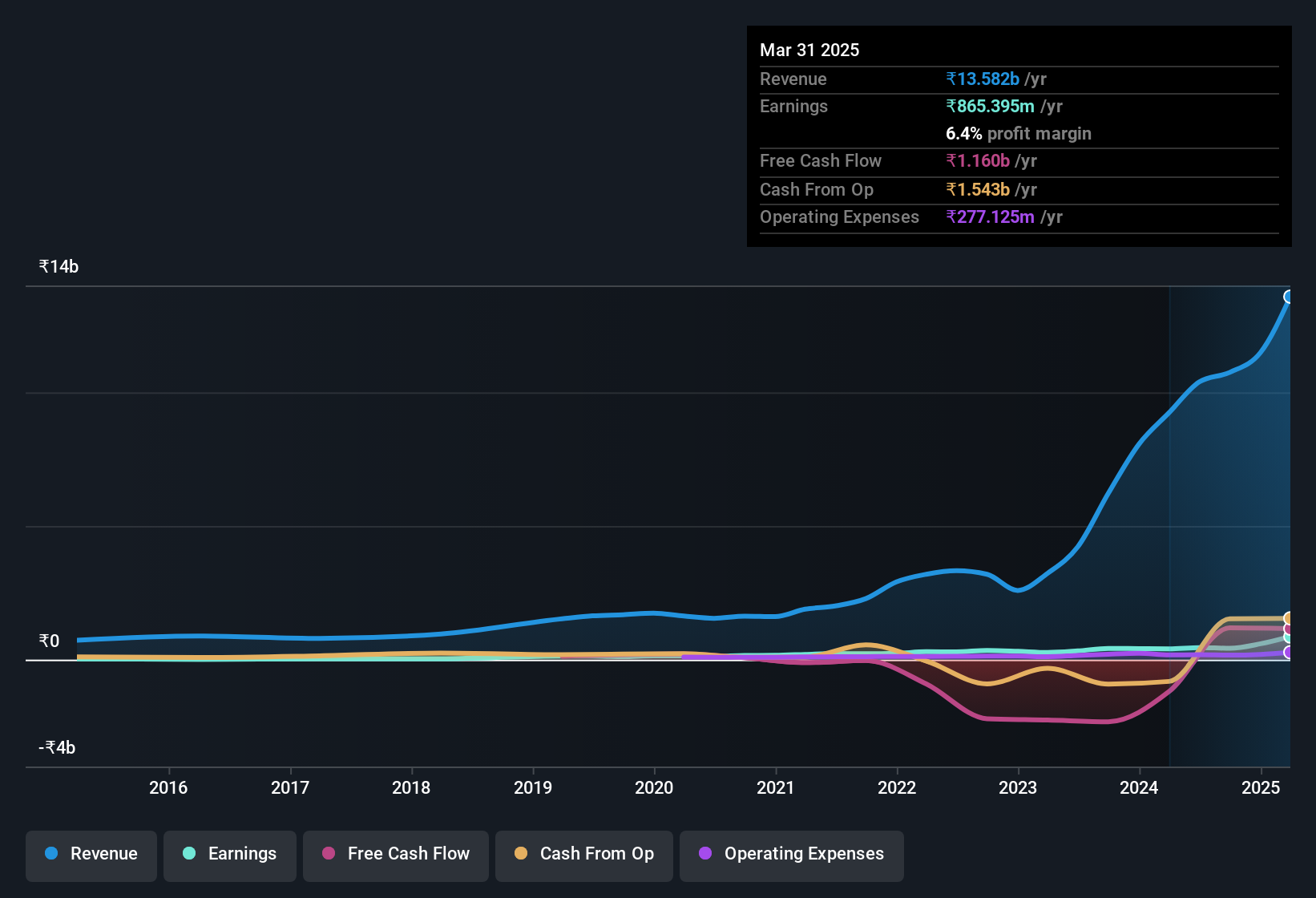

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Krishana Phoschem maintained stable EBIT margins over the last year, all while growing revenue 47% to ₹14b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

See our latest analysis for Krishana Phoschem

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Krishana Phoschem Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Krishana Phoschem will be more than happy to see insiders committing themselves to the company, spending ₹24m on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. We also note that it was the MD & Director, Praveen Ostwal, who made the biggest single acquisition, paying ₹12m for shares at about ₹205 each.

Along with the insider buying, another encouraging sign for Krishana Phoschem is that insiders, as a group, have a considerable shareholding. To be specific, they have ₹1.1b worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 4.0% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Krishana Phoschem To Your Watchlist?

Krishana Phoschem's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Krishana Phoschem deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Krishana Phoschem that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Krishana Phoschem, you'll probably love this curated collection of companies in IN that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Krishana Phoschem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KRISHANA

Krishana Phoschem

Engages in the manufacture and sale of fertilizers and chemicals under the Annadata and Bharat brands in India.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success