Jai's (NSE:JAICORPLTD) Profits May Not Reveal Underlying Issues

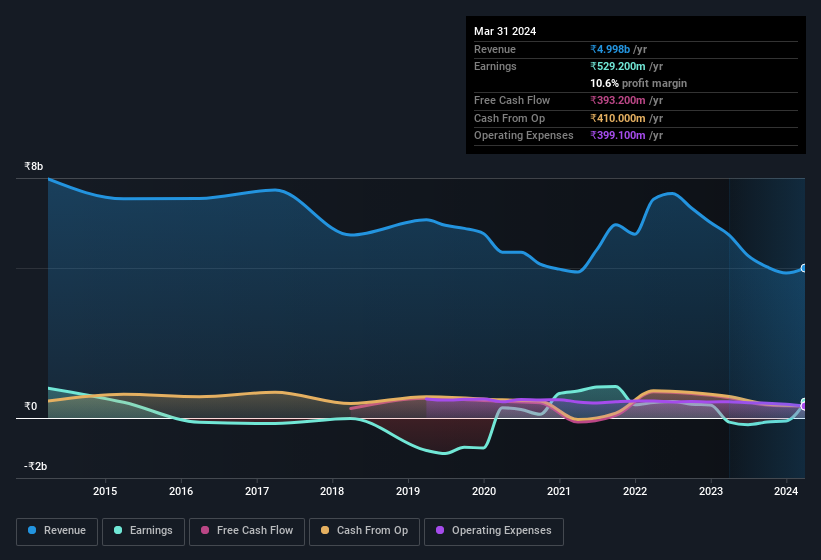

Jai Corp Limited's (NSE:JAICORPLTD ) stock didn't jump after it announced some healthy earnings. We did some digging and believe investors may be worried about some underlying factors in the report.

Check out our latest analysis for Jai

Operating Revenue Or Not?

Companies will classify their revenue streams as either operating revenue or other revenue. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. Notably, Jai had a significant increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from ₹155.3m to ₹366.9m. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Jai.

Our Take On Jai's Profit Performance

When considering the nature of Jai's earnings, we'd absolutely keep in mind that it saw an increase in non-operating revenue in the last year, which would in turn have boosted its profit, potentially in an unsustainable manner. Because of this, we think that it may be that Jai's statutory profits are better than its underlying earnings power. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. We've done some analysis and you can see our take on Jai's balance sheet by clicking here.

This note has only looked at a single factor that sheds light on the nature of Jai's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JAICORPLTD

Jai

Primarily engages in the plastic processing business in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives