- India

- /

- Basic Materials

- /

- NSEI:INDIACEM

Recent 7.8% pullback isn't enough to hurt long-term India Cements (NSE:INDIACEM) shareholders, they're still up 161% over 5 years

While The India Cements Limited (NSE:INDIACEM) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 27% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. Indeed, the share price is up an impressive 157% in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Ultimately business performance will determine whether the stock price continues the positive long term trend.

Although India Cements has shed ₹6.8b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for India Cements

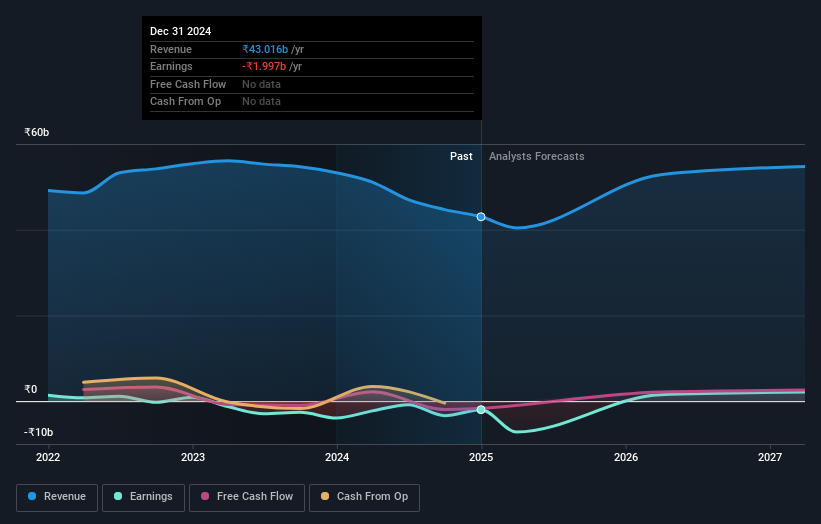

Because India Cements made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years India Cements saw its revenue grow at 0.7% per year. That's not a very high growth rate considering the bottom line. In comparison, the share price rise of 21% per year over the last half a decade is pretty impressive. While we wouldn't be overly concerned, it might be worth checking whether you think the fundamental business gains really justify the share price action. Some might suggest that the sentiment around the stock is rather positive.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling India Cements stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered India Cements' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for India Cements shareholders, and that cash payout contributed to why its TSR of 161%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that India Cements shareholders have received a total shareholder return of 4.6% over one year. However, the TSR over five years, coming in at 21% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. It's always interesting to track share price performance over the longer term. But to understand India Cements better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with India Cements (at least 1 which is concerning) , and understanding them should be part of your investment process.

Of course India Cements may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDIACEM

India Cements

Produces and sells cement and cement related products in India.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives