- India

- /

- Metals and Mining

- /

- NSEI:HITECH

Here's Why We Think Hi-Tech Pipes (NSE:HITECH) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hi-Tech Pipes (NSE:HITECH). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Hi-Tech Pipes

How Quickly Is Hi-Tech Pipes Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Hi-Tech Pipes has managed to grow EPS by 35% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

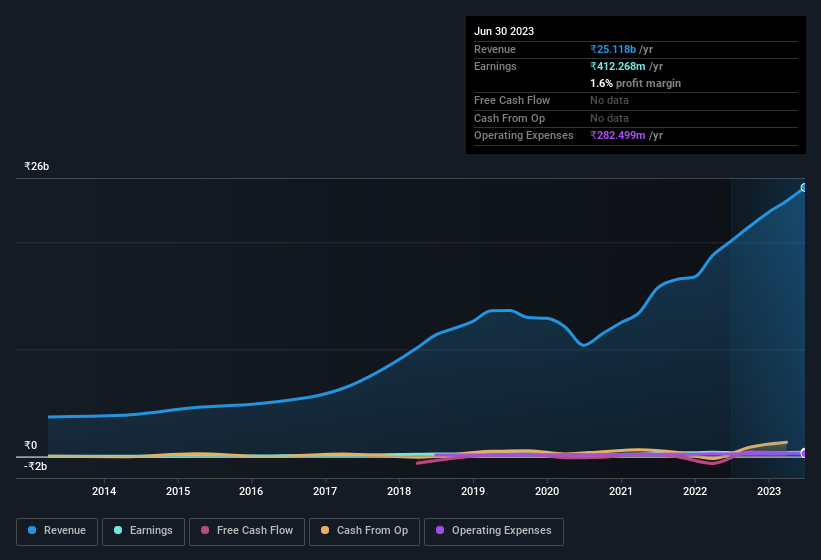

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Hi-Tech Pipes remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 25% to ₹25b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Hi-Tech Pipes is no giant, with a market capitalisation of ₹11b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Hi-Tech Pipes Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Hi-Tech Pipes will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 48% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. To give you an idea, the value of insiders' holdings in the business are valued at ₹5.3b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does Hi-Tech Pipes Deserve A Spot On Your Watchlist?

For growth investors, Hi-Tech Pipes' raw rate of earnings growth is a beacon in the night. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Still, you should learn about the 2 warning signs we've spotted with Hi-Tech Pipes (including 1 which shouldn't be ignored).

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hi-Tech Pipes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HITECH

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives