- India

- /

- Oil and Gas

- /

- NSEI:ONGC

3 Indian Dividend Stocks Yielding Up To 4.1%

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 3.6% drop, although it has risen by 40% over the past year with earnings projected to grow by 17% annually in the coming years. In such a dynamic market environment, dividend stocks offering attractive yields can provide investors with steady income and potential for capital appreciation.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.49% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 4.63% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.26% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.30% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 6.17% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.80% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.29% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.36% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.87% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.03% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Indian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

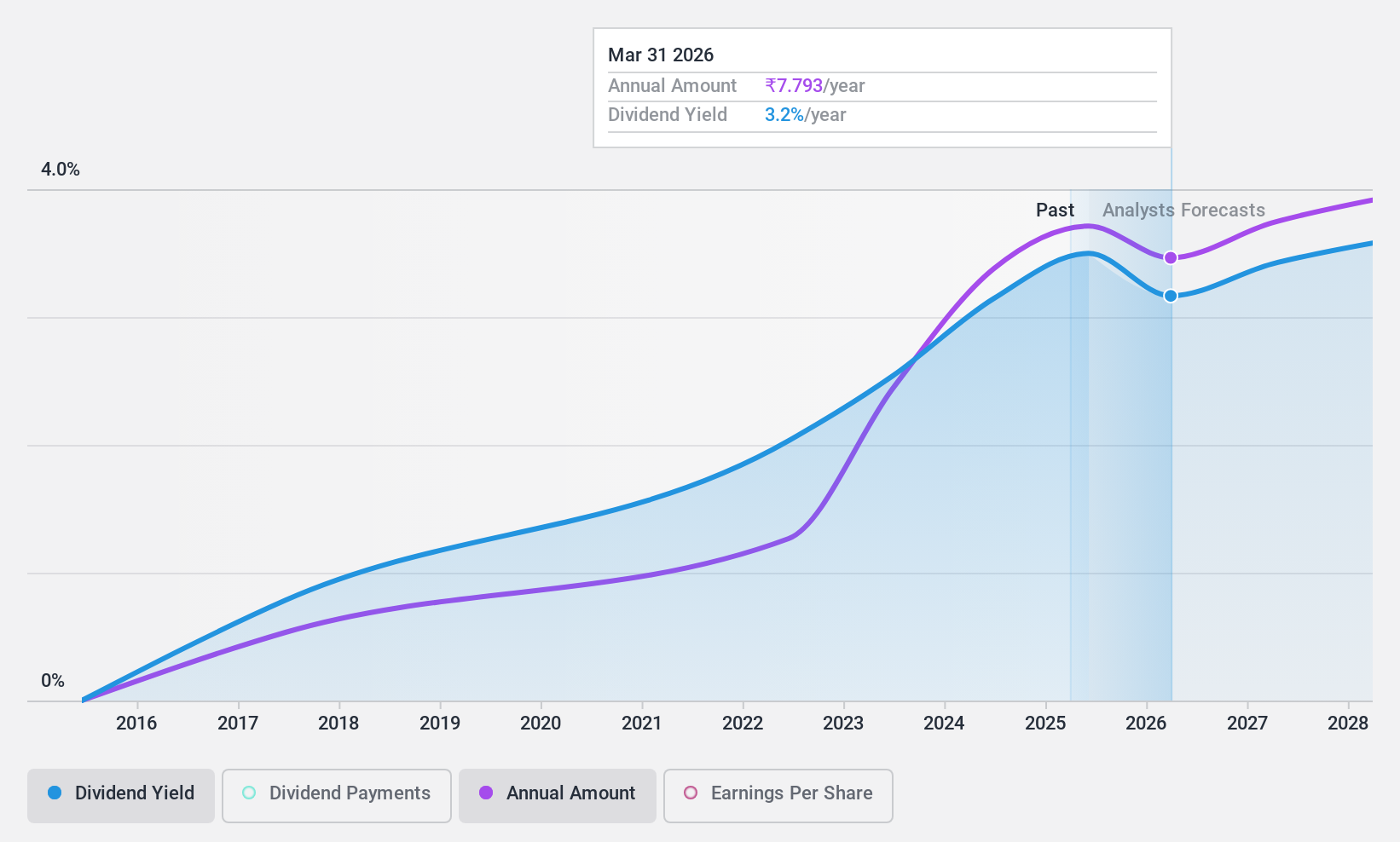

Bank of Baroda (NSEI:BANKBARODA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Baroda Limited offers a range of banking products and services to individuals, government departments, and corporate customers both in India and internationally, with a market cap of ₹1.30 trillion.

Operations: Bank of Baroda Limited's revenue is primarily derived from its Corporate/Wholesale Banking segment at ₹502.78 billion, followed by Retail Banking - Other Retail Banking at ₹512.25 billion, Treasury activities contributing ₹316.82 billion, and Other Banking Operations generating ₹110.76 billion.

Dividend Yield: 3%

Bank of Baroda's dividend yield is in the top 25% of Indian market payers, supported by a low payout ratio of 20.9%, indicating strong earnings coverage. However, its dividend history has been volatile over the past decade, raising concerns about reliability. Despite this instability, recent strategic initiatives like launching a co-branded travel debit card and completing significant fixed-income offerings demonstrate efforts to enhance customer engagement and financial stability, potentially impacting future dividend sustainability positively.

- Dive into the specifics of Bank of Baroda here with our thorough dividend report.

- Upon reviewing our latest valuation report, Bank of Baroda's share price might be too pessimistic.

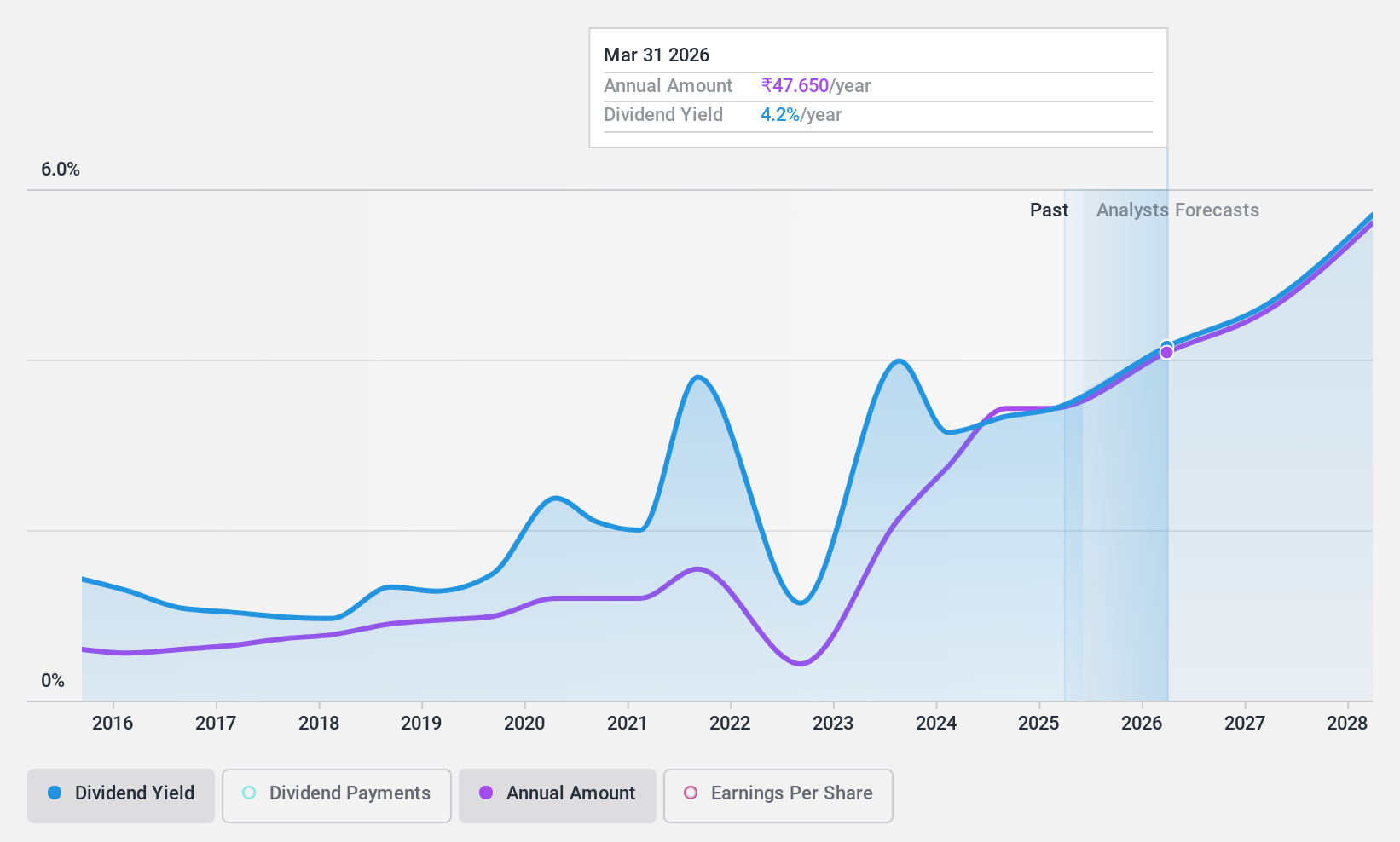

Gulf Oil Lubricants India (NSEI:GULFOILLUB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited manufactures, markets, and trades lubricating oils, greases, and other derivatives for the automobile and industrial sectors in India with a market cap of ₹65.33 billion.

Operations: The company's revenue is primarily derived from its lubricants segment, amounting to ₹33.83 billion.

Dividend Yield: 3%

Gulf Oil Lubricants India's dividend yield ranks in the top 25% of Indian market payers, with a payout ratio of 57.4%, indicating earnings coverage. Despite this, its dividend history has been volatile and unreliable over the past decade. Recent developments include its addition to the S&P Global BMI Index and key management changes, which may influence future performance. The company's price-to-earnings ratio is favorable compared to industry peers, suggesting good relative value for investors.

- Delve into the full analysis dividend report here for a deeper understanding of Gulf Oil Lubricants India.

- Our valuation report here indicates Gulf Oil Lubricants India may be undervalued.

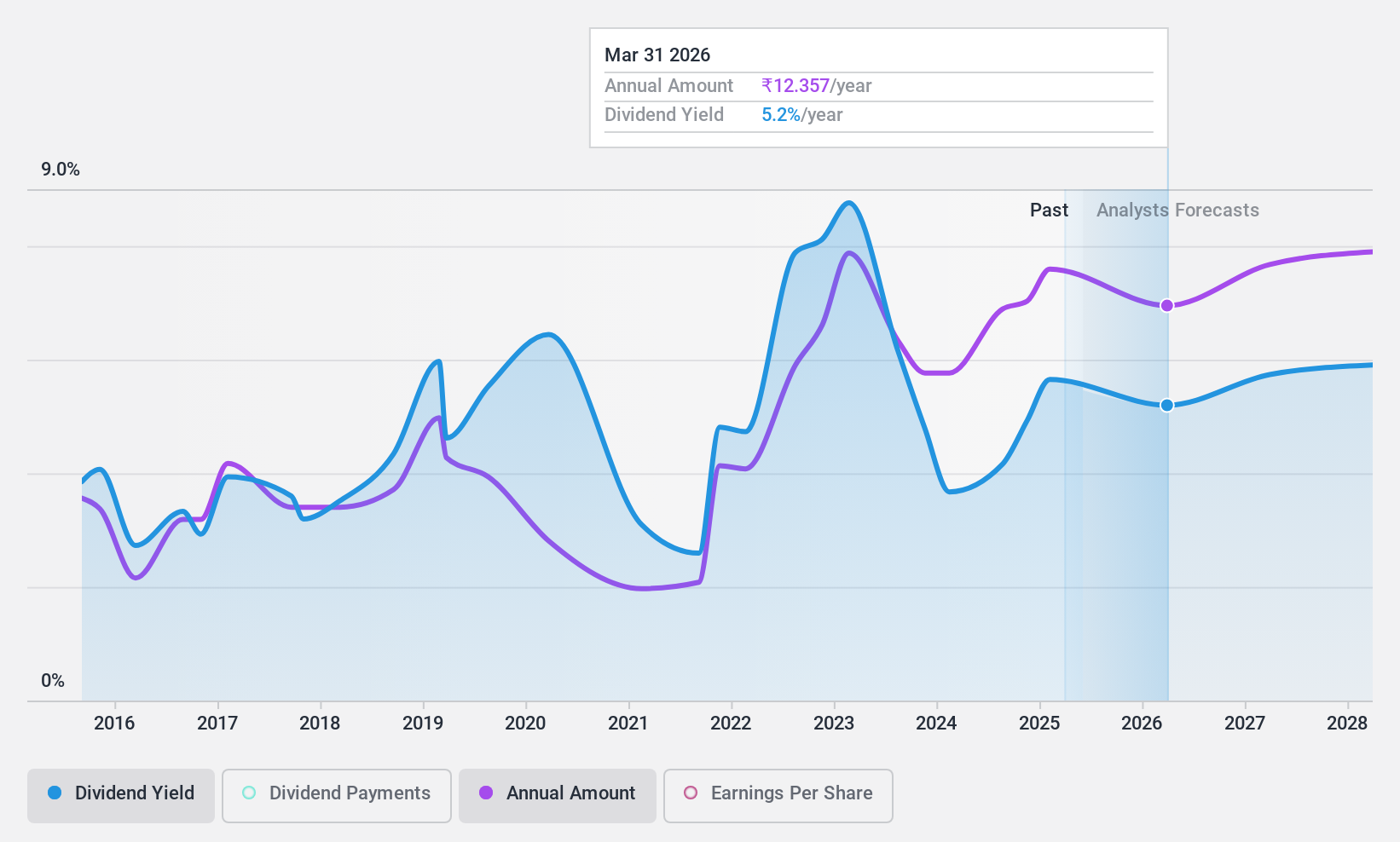

Oil and Natural Gas (NSEI:ONGC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited, along with its subsidiaries, is involved in the exploration, development, and production of crude oil and natural gas both in India and internationally, with a market cap of ₹3.71 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily from its operations in India, with ₹5.72 billion from refining and marketing, ₹441.92 million from onshore exploration and production, ₹953.81 million from offshore exploration and production, supplemented by international activities contributing ₹96.69 million.

Dividend Yield: 4.1%

Oil and Natural Gas Corporation's dividend yield is among the top 25% in India, supported by a low payout ratio of 31.3%, ensuring earnings and cash flow coverage. However, its dividends have been volatile over the past decade. Recent management changes might affect strategic direction, while ongoing investments in renewable energy projects highlight potential growth avenues. The company's price-to-earnings ratio remains attractive compared to the broader Indian market, suggesting potential value for investors seeking dividend income.

- Unlock comprehensive insights into our analysis of Oil and Natural Gas stock in this dividend report.

- The analysis detailed in our Oil and Natural Gas valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Unlock our comprehensive list of 19 Top Indian Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Oil and Natural Gas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ONGC

Oil and Natural Gas

Engages in the exploration, development, and production of crude oil and natural gas in India and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives