Garware Hi-Tech Films Limited's (NSE:GRWRHITECH) Shares Climb 31% But Its Business Is Yet to Catch Up

Despite an already strong run, Garware Hi-Tech Films Limited (NSE:GRWRHITECH) shares have been powering on, with a gain of 31% in the last thirty days. The last month tops off a massive increase of 251% in the last year.

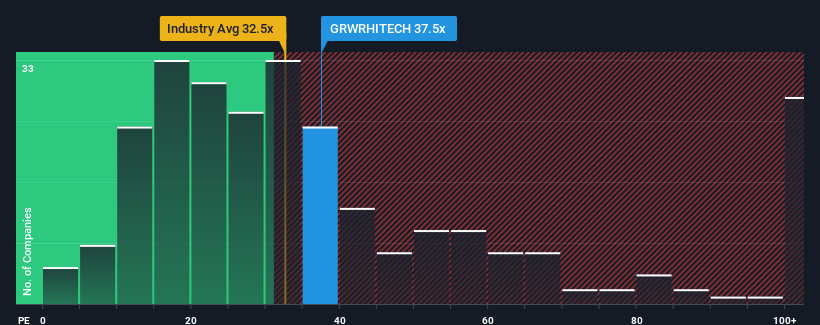

After such a large jump in price, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider Garware Hi-Tech Films as a stock to potentially avoid with its 37.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's exceedingly strong of late, Garware Hi-Tech Films has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Garware Hi-Tech Films

Does Growth Match The High P/E?

Garware Hi-Tech Films' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 88% last year. The latest three year period has also seen an excellent 99% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

It's interesting to note that the rest of the market is similarly expected to grow by 26% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Garware Hi-Tech Films' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

The Bottom Line On Garware Hi-Tech Films' P/E

Garware Hi-Tech Films shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Garware Hi-Tech Films revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Garware Hi-Tech Films you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Garware Hi-Tech Films, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GRWRHITECH

Garware Hi-Tech Films

Manufactures and sells polyester films in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives