- India

- /

- Paper and Forestry Products

- /

- NSEI:GENUSPAPER

Shareholders Will Probably Not Have Any Issues With Genus Paper & Boards Limited's (NSE:GENUSPAPER) CEO Compensation

Key Insights

- Genus Paper & Boards to hold its Annual General Meeting on 29th of September

- Salary of ₹6.72m is part of CEO Kailash Agarwal's total remuneration

- The total compensation is similar to the average for the industry

- Over the past three years, Genus Paper & Boards' EPS fell by 53% and over the past three years, the total shareholder return was 17%

Under the guidance of CEO Kailash Agarwal, Genus Paper & Boards Limited (NSE:GENUSPAPER) has performed reasonably well recently. As shareholders go into the upcoming AGM on 29th of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

See our latest analysis for Genus Paper & Boards

Comparing Genus Paper & Boards Limited's CEO Compensation With The Industry

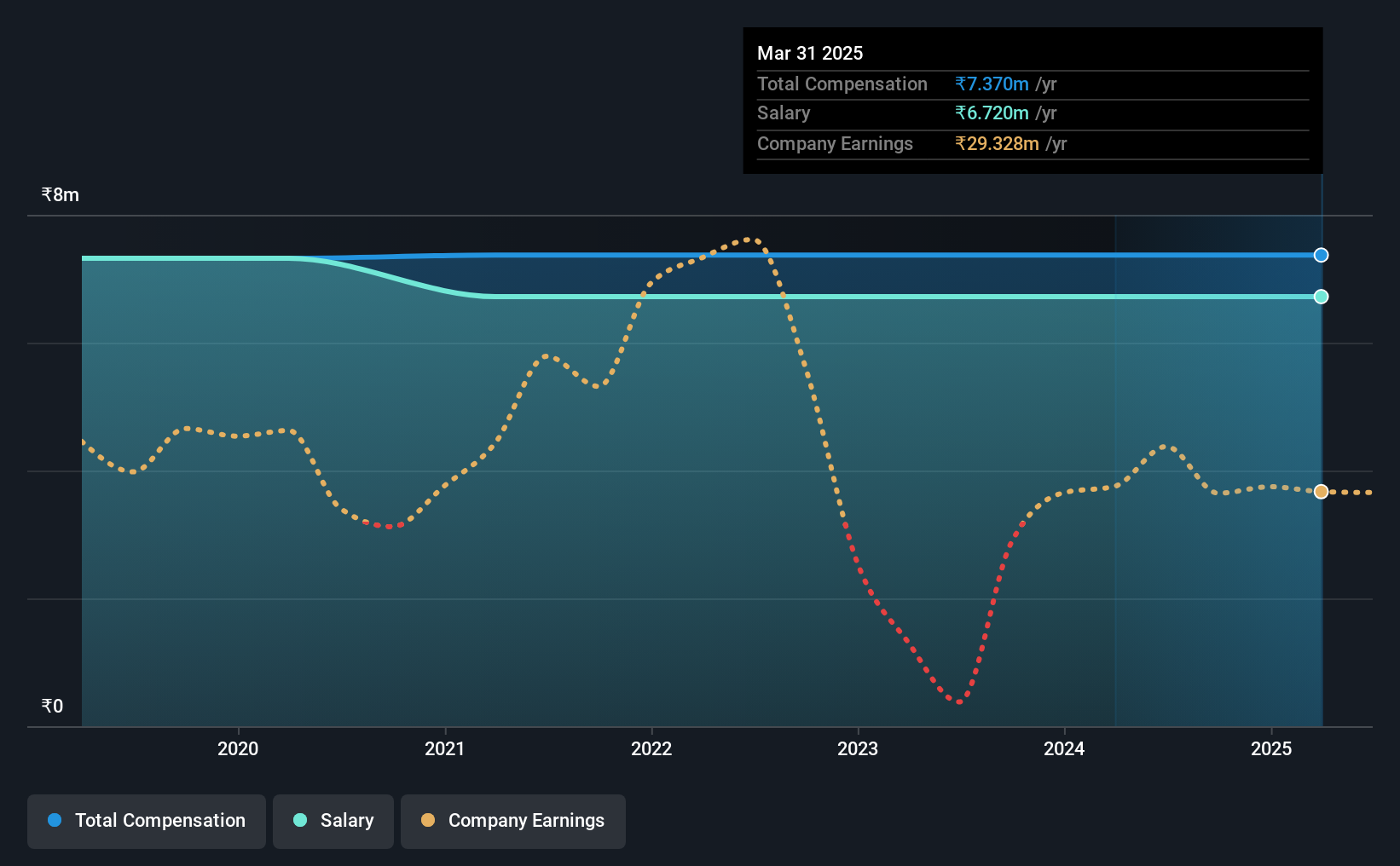

At the time of writing, our data shows that Genus Paper & Boards Limited has a market capitalization of ₹4.6b, and reported total annual CEO compensation of ₹7.4m for the year to March 2025. There was no change in the compensation compared to last year. Notably, the salary which is ₹6.72m, represents most of the total compensation being paid.

On comparing similar-sized companies in the Indian Forestry industry with market capitalizations below ₹18b, we found that the median total CEO compensation was ₹5.9m. From this we gather that Kailash Agarwal is paid around the median for CEOs in the industry. Moreover, Kailash Agarwal also holds ₹273m worth of Genus Paper & Boards stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹6.7m | ₹6.7m | 91% |

| Other | ₹650k | ₹650k | 9% |

| Total Compensation | ₹7.4m | ₹7.4m | 100% |

On an industry level, roughly 92% of total compensation represents salary and 8% is other remuneration. There isn't a significant difference between Genus Paper & Boards and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Genus Paper & Boards Limited's Growth

Genus Paper & Boards Limited has reduced its earnings per share by 53% a year over the last three years. It achieved revenue growth of 22% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Genus Paper & Boards Limited Been A Good Investment?

Genus Paper & Boards Limited has generated a total shareholder return of 17% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

The overall company performance has been commendable, however there are still areas for improvement. Despite robust revenue growth, until EPS growth improves, shareholders may be hesitant to increase CEO pay by too much.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 4 warning signs for Genus Paper & Boards (of which 2 are potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Genus Paper & Boards, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GENUSPAPER

Genus Paper & Boards

Primarily manufactures and sells kraft paper in India and internationally.

Solid track record with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)