Rainbows and Unicorns: Fine Organic Industries Limited (NSE:FINEORG) Analysts Just Became A Lot More Optimistic

Shareholders in Fine Organic Industries Limited (NSE:FINEORG) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

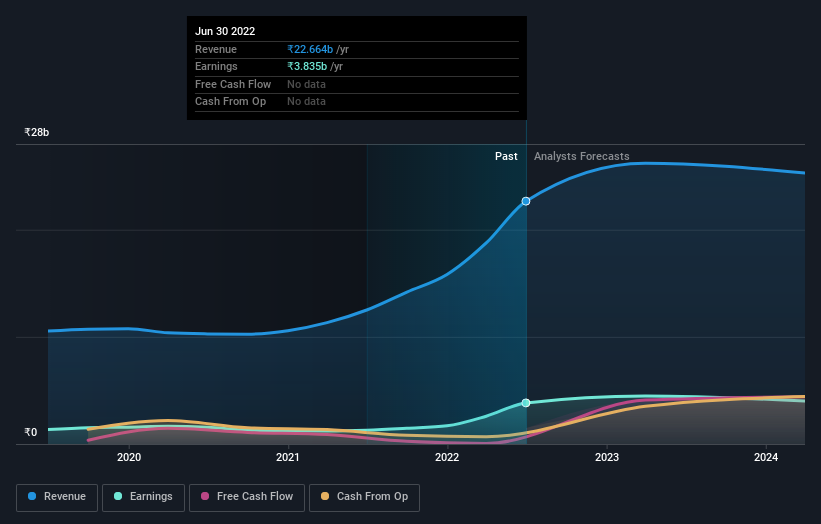

Following the upgrade, the current consensus from Fine Organic Industries' six analysts is for revenues of ₹27b in 2023 which - if met - would reflect a meaningful 18% increase on its sales over the past 12 months. Per-share earnings are expected to soar 22% to ₹153. Before this latest update, the analysts had been forecasting revenues of ₹24b and earnings per share (EPS) of ₹118 in 2023. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

See our latest analysis for Fine Organic Industries

With these upgrades, we're not surprised to see that the analysts have lifted their price target 14% to ₹5,482 per share. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Fine Organic Industries at ₹7,567 per share, while the most bearish prices it at ₹3,560. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The period to the end of 2023 brings more of the same, according to the analysts, with revenue forecast to display 25% growth on an annualised basis. That is in line with its 25% annual growth over the past three years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 12% annually. So although Fine Organic Industries is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Fine Organic Industries could be worth investigating further.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Fine Organic Industries going out to 2024, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you're looking to trade Fine Organic Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FINEORG

Fine Organic Industries

Engages in manufacture, processing, supply, distribution, dealing, import, and export of oleochemical-based additives in India and internationally.

Flawless balance sheet with acceptable track record.