Fineotex Chemical Limited (NSE:FCL) Stock Rockets 34% As Investors Are Less Pessimistic Than Expected

Fineotex Chemical Limited (NSE:FCL) shareholders have had their patience rewarded with a 34% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 73% in the last year.

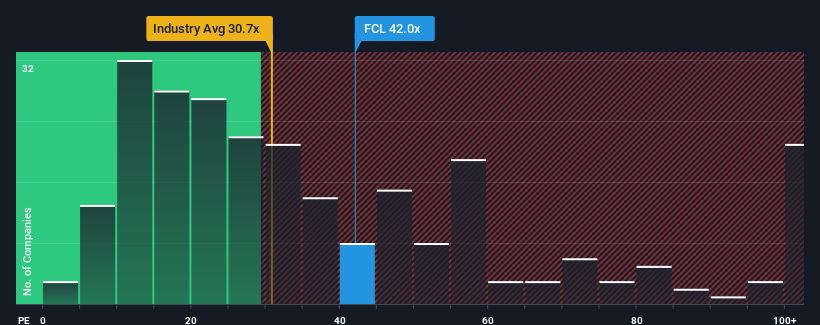

After such a large jump in price, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider Fineotex Chemical as a stock to potentially avoid with its 42x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been advantageous for Fineotex Chemical as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Fineotex Chemical

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Fineotex Chemical's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 46% last year. The strong recent performance means it was also able to grow EPS by 361% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 24% over the next year. Meanwhile, the rest of the market is forecast to expand by 24%, which is not materially different.

In light of this, it's curious that Fineotex Chemical's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Fineotex Chemical's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Fineotex Chemical's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Fineotex Chemical with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Fineotex Chemical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FCL

Fineotex Chemical

Engages in manufactures and sells textile chemicals, and auxiliary and specialty chemicals in India.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives