3 Indian Stocks Estimated To Be Up To 34.8% Below Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.2%, and over the past 12 months, it is up by an impressive 41%. In this growing market, identifying undervalued stocks can provide significant opportunities for investors looking to capitalize on potential gains.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹200.09 | ₹306.68 | 34.8% |

| Apollo Pipes (BSE:531761) | ₹599.65 | ₹1139.17 | 47.4% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1252.70 | ₹2163.75 | 42.1% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹481.95 | ₹762.32 | 36.8% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹853.45 | ₹1509.79 | 43.5% |

| Patel Engineering (BSE:531120) | ₹57.57 | ₹93.28 | 38.3% |

| IRB Infrastructure Developers (NSEI:IRB) | ₹59.01 | ₹92.60 | 36.3% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹280.80 | ₹445.15 | 36.9% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1361.65 | ₹2142.32 | 36.4% |

| Strides Pharma Science (NSEI:STAR) | ₹1328.00 | ₹2032.10 | 34.6% |

Let's explore several standout options from the results in the screener.

Awfis Space Solutions (NSEI:AWFIS)

Overview: Awfis Space Solutions Limited provides flexible workspace solutions in India and has a market cap of ₹51.15 billion.

Operations: Awfis generates revenue primarily through Co-Working Space on Rent and Allied Services (₹6.65 billion) and Construction and Fit-Out Projects (₹2.29 billion).

Estimated Discount To Fair Value: 16.8%

Awfis Space Solutions, trading at ₹728.55, is undervalued with an estimated fair value of ₹875.29. Despite significant insider selling and high share price volatility recently, Awfis has shown strong earnings growth of 30.4% annually over the past five years and is expected to grow revenue by 28.8% per year moving forward. The company’s recent expansion into GIFT City and partnerships in Pune highlight its strategic growth initiatives in premium flexible workspaces across key Indian markets.

- Upon reviewing our latest growth report, Awfis Space Solutions' projected financial performance appears quite optimistic.

- Dive into the specifics of Awfis Space Solutions here with our thorough financial health report.

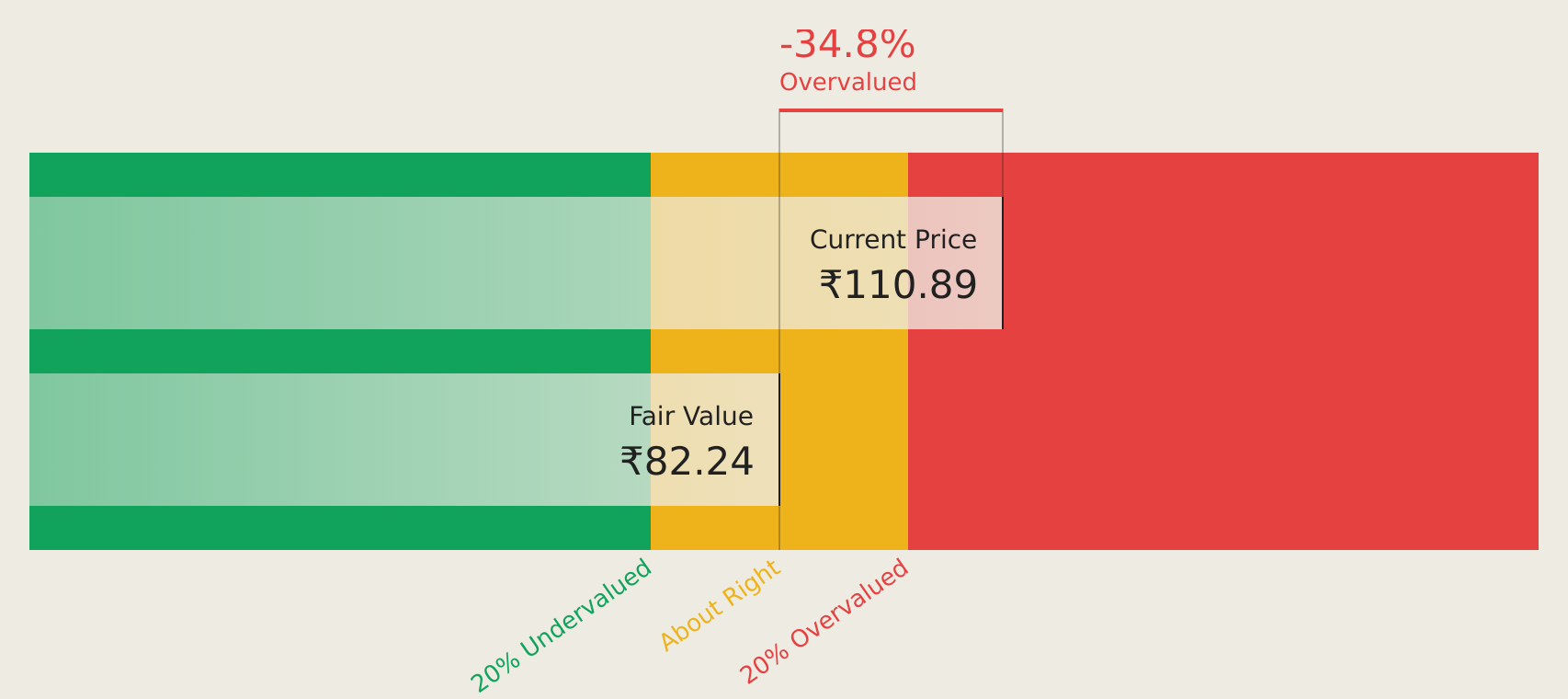

Everest Kanto Cylinder (NSEI:EKC)

Overview: Everest Kanto Cylinder Limited, along with its subsidiaries, manufactures and sells gas cylinders in India and has a market cap of ₹22.45 billion.

Operations: Everest Kanto Cylinder Limited generates revenue primarily from the manufacturing and sale of gas cylinders in India.

Estimated Discount To Fair Value: 34.8%

Everest Kanto Cylinder, trading at ₹200.09, is significantly undervalued with an estimated fair value of ₹306.68. Recent earnings reports show robust growth, with Q1 2024 revenue at ₹3.46 billion and net income at ₹280.5 million, up from last year’s figures. Forecasts indicate annual earnings growth of 27.51%, outpacing the Indian market's average of 17.2%. Despite an unstable dividend track record, EKC’s strong cash flow metrics make it a compelling consideration for value investors.

- Our growth report here indicates Everest Kanto Cylinder may be poised for an improving outlook.

- Get an in-depth perspective on Everest Kanto Cylinder's balance sheet by reading our health report here.

Quess (NSEI:QUESS)

Overview: Quess Corp Limited is a business services provider operating in India, South East Asia, the Middle East, and North America with a market cap of ₹125.25 billion.

Operations: The company's revenue segments include Product Led Business (₹4.29 billion), Workforce Management (₹138.44 billion), Operating Asset Management (₹28.43 billion), and Global Technology Solutions excluding Product Led Business (₹23.87 billion).

Estimated Discount To Fair Value: 21.4%

Quess Corp, trading at ₹842.7, is undervalued by over 20% with an estimated fair value of ₹1072.03. The company reported strong earnings growth of 62.5% in the past year and forecasts suggest annual profit growth of 22.8%, outpacing the Indian market's average of 17.2%. Despite an unstable dividend track record, Quess's robust cash flow metrics and significant earnings potential make it a noteworthy consideration for value investors focused on cash flows.

- Our expertly prepared growth report on Quess implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Quess.

Turning Ideas Into Actions

- Gain an insight into the universe of 26 Undervalued Indian Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Everest Kanto Cylinder, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

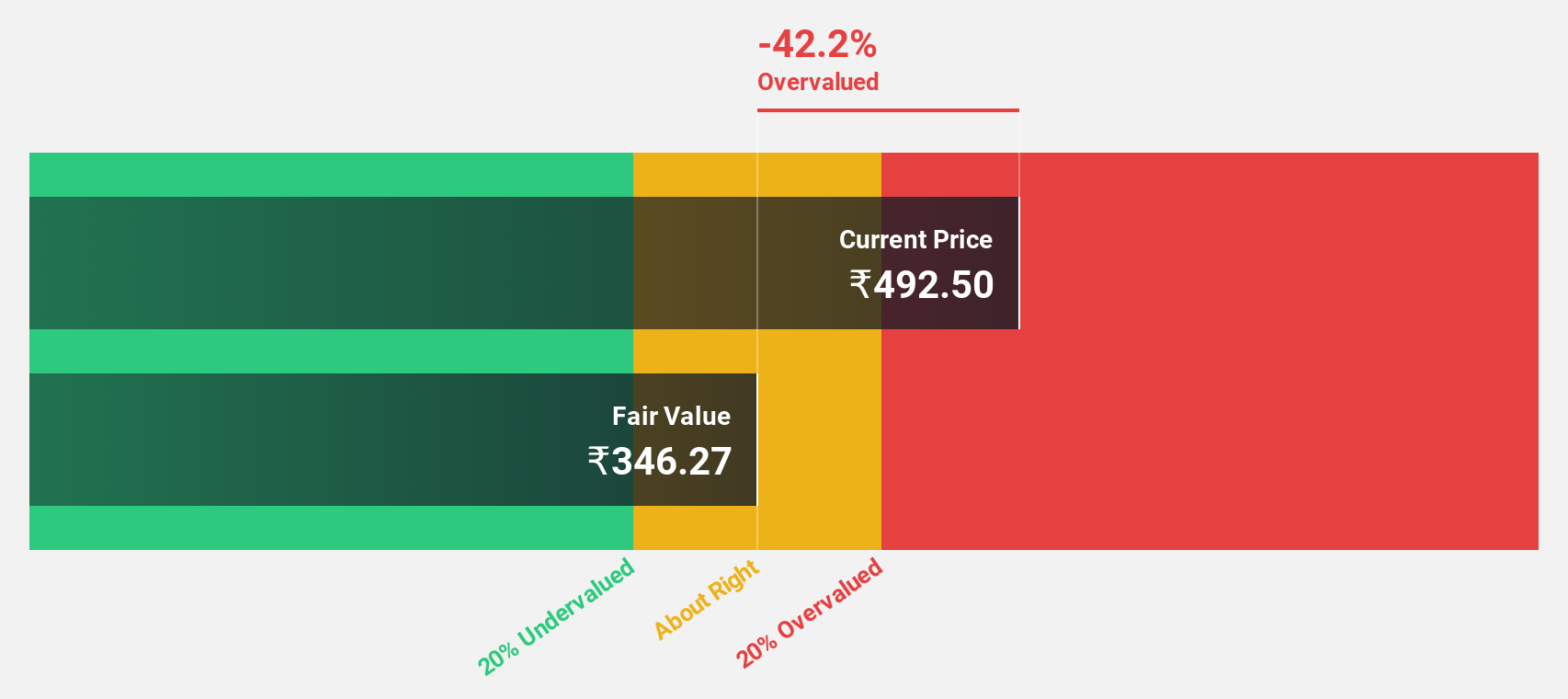

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Everest Kanto Cylinder might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:EKC

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives