Clean Science and Technology's (NSE:CLEAN) Problems Go Beyond Weak Profit

Clean Science and Technology Limited's (NSE:CLEAN) recent weak earnings report didn't cause a big stock movement. However, we believe that investors should be aware of some underlying factors which may be of concern.

Check out our latest analysis for Clean Science and Technology

Examining Cashflow Against Clean Science and Technology's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

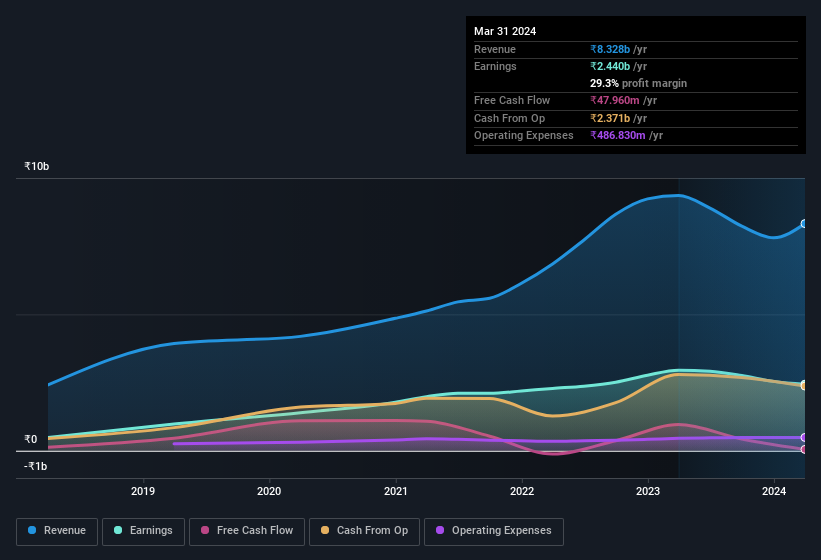

For the year to March 2024, Clean Science and Technology had an accrual ratio of 0.31. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. In fact, it had free cash flow of ₹48m in the last year, which was a lot less than its statutory profit of ₹2.44b. Clean Science and Technology shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Clean Science and Technology's Profit Performance

Clean Science and Technology didn't convert much of its profit to free cash flow in the last year, which some investors may consider rather suboptimal. Therefore, it seems possible to us that Clean Science and Technology's true underlying earnings power is actually less than its statutory profit. Nonetheless, it's still worth noting that its earnings per share have grown at 23% over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Clean Science and Technology at this point in time. For example, Clean Science and Technology has 2 warning signs (and 1 which is concerning) we think you should know about.

Today we've zoomed in on a single data point to better understand the nature of Clean Science and Technology's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CLEAN

Clean Science and Technology

Manufactures fine and specialty chemicals in India, China, the Americas, Europe, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026