Chemcon Speciality Chemicals Limited's (NSE:CHEMCON) Business Is Yet to Catch Up With Its Share Price

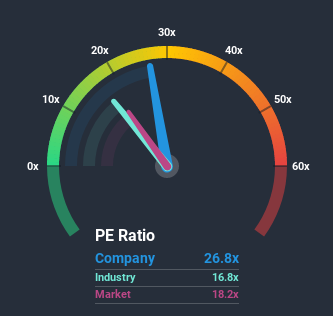

With a price-to-earnings (or "P/E") ratio of 26.8x Chemcon Speciality Chemicals Limited (NSE:CHEMCON) may be sending bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 18x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's lofty.

Chemcon Speciality Chemicals has been doing a decent job lately as it's been growing earnings at a reasonable pace. One possibility is that the P/E is high because investors think this good earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Chemcon Speciality Chemicals

How Is Chemcon Speciality Chemicals' Growth Trending?

Chemcon Speciality Chemicals' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 2.9% last year. Pleasingly, EPS has also lifted 85% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 35% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Chemcon Speciality Chemicals is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Chemcon Speciality Chemicals currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Chemcon Speciality Chemicals with six simple checks on some of these key factors.

You might be able to find a better investment than Chemcon Speciality Chemicals. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

When trading Chemcon Speciality Chemicals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CHEMCON

Chemcon Speciality Chemicals

Engages in the manufacture and sale of speciality chemicals for pharmaceutical, agro-chemical, and engineering and oilfield chemicals industries in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives