- India

- /

- Paper and Forestry Products

- /

- NSEI:CENTURYPLY

Century Plyboards (India) Limited Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Predictions

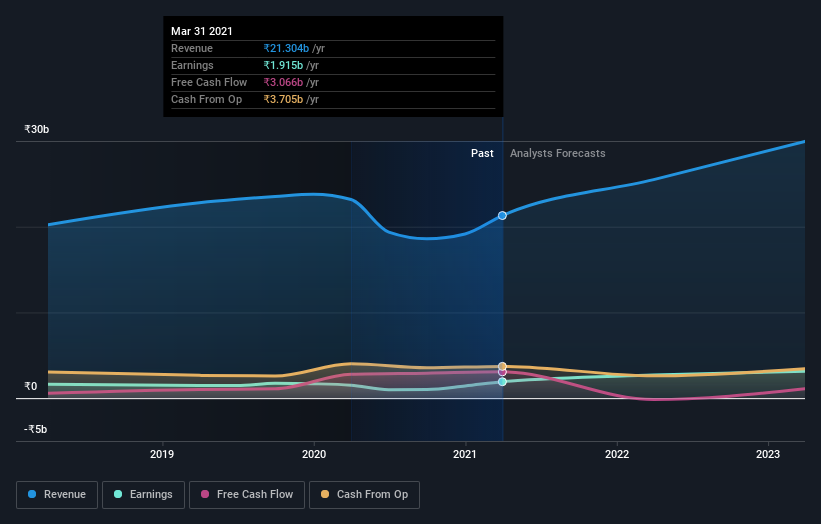

A week ago, Century Plyboards (India) Limited (NSE:CENTURYPLY) came out with a strong set of annual numbers that could potentially lead to a re-rate of the stock. Century Plyboards (India) beat earnings, with revenues hitting ₹21b, ahead of expectations, and statutory earnings per share outperforming analyst reckonings by a solid 15%. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Century Plyboards (India)

Taking into account the latest results, the most recent consensus for Century Plyboards (India) from five analysts is for revenues of ₹25.5b in 2022 which, if met, would be a notable 20% increase on its sales over the past 12 months. Statutory earnings per share are predicted to jump 40% to ₹12.05. In the lead-up to this report, the analysts had been modelling revenues of ₹25.1b and earnings per share (EPS) of ₹11.32 in 2022. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

The consensus price target rose 12% to ₹366, suggesting that higher earnings estimates flow through to the stock's valuation as well. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Century Plyboards (India) at ₹487 per share, while the most bearish prices it at ₹260. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Century Plyboards (India)'s rate of growth is expected to accelerate meaningfully, with the forecast 20% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 3.4% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 12% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Century Plyboards (India) to grow faster than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Century Plyboards (India) following these results. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Century Plyboards (India) going out to 2023, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Century Plyboards (India) , and understanding this should be part of your investment process.

When trading Century Plyboards (India) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Century Plyboards (India), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CENTURYPLY

Century Plyboards (India)

Manufactures and sells plywood, laminates, decorative veneers, medium density fiber boards (MDF), pre-laminated boards, particle boards, and flush doors in India.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives