- India

- /

- Basic Materials

- /

- NSEI:BIGBLOC

Does Bigbloc Construction (NSE:BIGBLOC) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Bigbloc Construction (NSE:BIGBLOC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Bigbloc Construction

How Fast Is Bigbloc Construction Growing Its Earnings Per Share?

Bigbloc Construction has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Bigbloc Construction's EPS catapulted from ₹1.70 to ₹4.55, over the last year. Year on year growth of 167% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

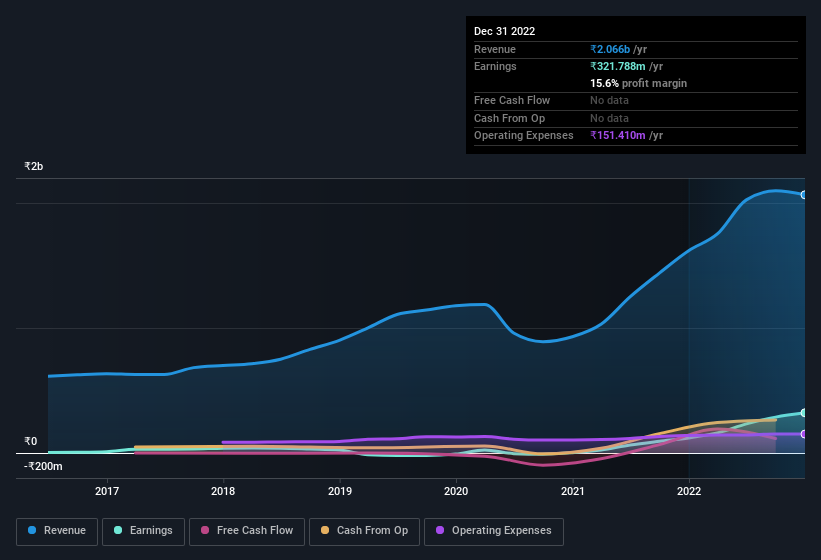

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Bigbloc Construction shareholders is that EBIT margins have grown from 11% to 21% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Bigbloc Construction is no giant, with a market capitalisation of ₹11b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Bigbloc Construction Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Bigbloc Construction followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Indeed, they hold ₹3.8b worth of its stock. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 35% of the shares on issue for the business, an appreciable amount considering the market cap.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Bigbloc Construction, with market caps under ₹16b is around ₹3.4m.

The Bigbloc Construction CEO received total compensation of only ₹1.3m in the year to March 2022. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Bigbloc Construction Deserve A Spot On Your Watchlist?

Bigbloc Construction's earnings per share growth have been climbing higher at an appreciable rate. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so the writing on the wall tells us that Bigbloc Construction is worth considering carefully. You should always think about risks though. Case in point, we've spotted 2 warning signs for Bigbloc Construction you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bigbloc Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BIGBLOC

Bigbloc Construction

Engages in the manufacturing, sales, and marketing of aerated autoclave concrete blocks in India.

Low risk with questionable track record.

Market Insights

Community Narratives