Do Agro Phos (India)'s (NSE:AGROPHOS) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Agro Phos (India) (NSE:AGROPHOS). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Agro Phos (India)

Agro Phos (India)'s Improving Profits

Agro Phos (India) has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, Agro Phos (India)'s EPS shot from ₹1.80 to ₹3.70, over the last year. Year on year growth of 105% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

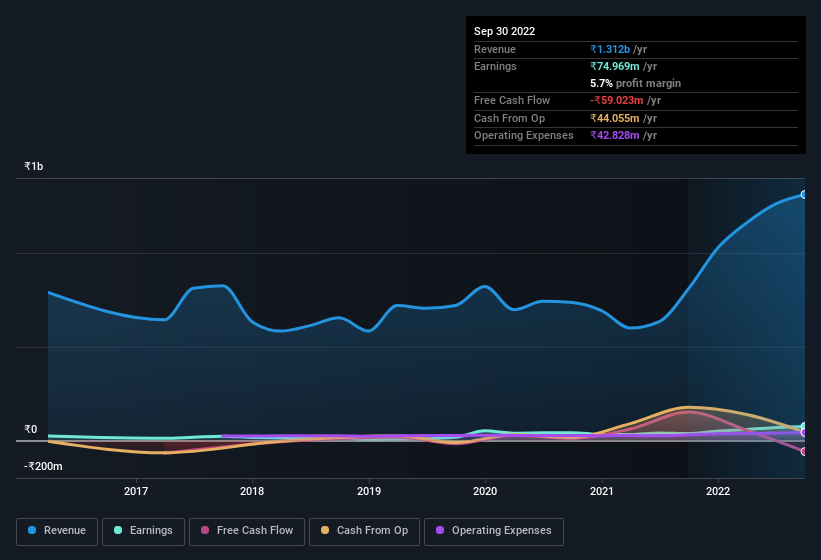

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that, last year, Agro Phos (India)'s revenue from operations was lower than its revenue, so that could distort our analysis of its margins. EBIT margins for Agro Phos (India) remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 62% to ₹1.3b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Agro Phos (India) is no giant, with a market capitalisation of ₹1.0b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Agro Phos (India) Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Agro Phos (India) insiders own a significant number of shares certainly is appealing. Actually, with 44% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only ₹1.0b Agro Phos (India) is really small for a listed company. So despite a large proportional holding, insiders only have ₹445m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Agro Phos (India) Worth Keeping An Eye On?

Agro Phos (India)'s earnings per share growth have been climbing higher at an appreciable rate. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering Agro Phos (India) for a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Agro Phos (India) (at least 1 which is significant) , and understanding these should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AGROPHOS

Agro Phos (India)

Engages in the manufacture and sale of fertilizers in India.

Adequate balance sheet low.

Market Insights

Community Narratives