Undiscovered Gems In India Top 3 Stocks To Watch This September 2024

Reviewed by Simply Wall St

In the last week, the Indian market has risen by 1.7%, and over the past year, it has climbed an impressive 41%, with earnings forecasted to grow by 17% annually. In this robust environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding for investors looking to capitalize on India's dynamic market.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Network People Services Technologies | 0.24% | 81.82% | 86.35% | ★★★★★☆ |

| Kaycee Industries | 17.35% | 19.50% | 34.62% | ★★★★★☆ |

| Insolation Energy | 88.64% | 163.87% | 419.31% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 20.01% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Advanced Enzyme Technologies (NSEI:ADVENZYMES)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Enzyme Technologies Limited, together with its subsidiaries, engages in the research, development, manufacture, and marketing of enzymes and probiotics in India, Europe, the United States, Asia, and internationally with a market cap of ₹59.63 billion.

Operations: The primary revenue stream for Advanced Enzyme Technologies is the manufacturing and sales of enzymes, generating ₹6.31 billion.

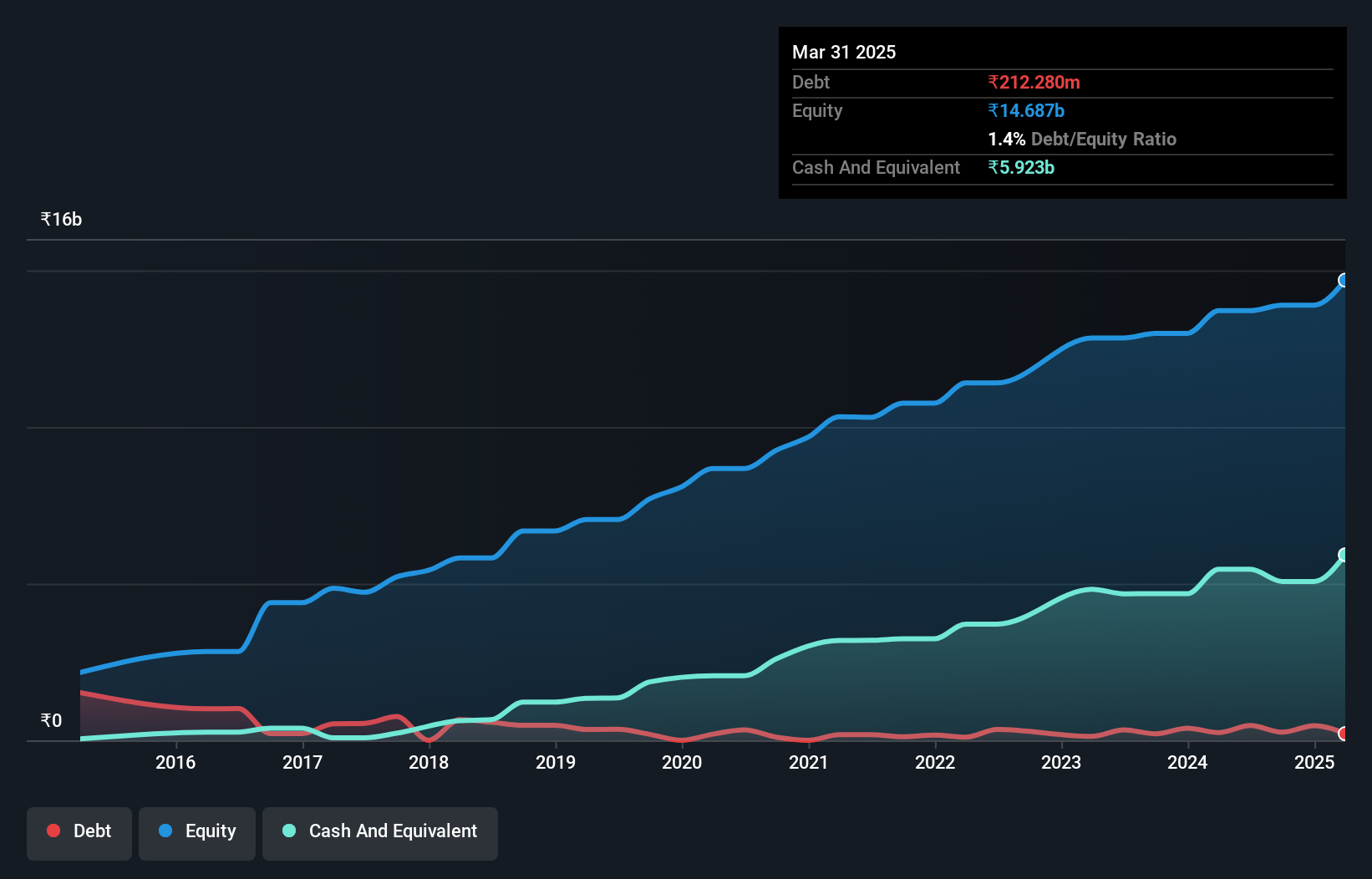

Advanced Enzyme Technologies, a promising player in the enzyme sector, has seen its debt to equity ratio drop from 5% to 3.5% over five years. The company reported Q1 2024 net income of INR 341.52 million, up from INR 288.1 million last year. Earnings per share rose to INR 3.05 from INR 2.58 previously, reflecting solid performance despite significant insider selling recently observed and earnings growth of nearly double the industry average at 18.9%.

- Click to explore a detailed breakdown of our findings in Advanced Enzyme Technologies' health report.

Learn about Advanced Enzyme Technologies' historical performance.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, with a market cap of ₹125.82 billion, is involved in the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand.

Operations: Marksans Pharma Limited generates revenue primarily from its pharmaceutical formulations segment, amounting to ₹22.68 billion. The company's net profit margin is a key indicator of its profitability.

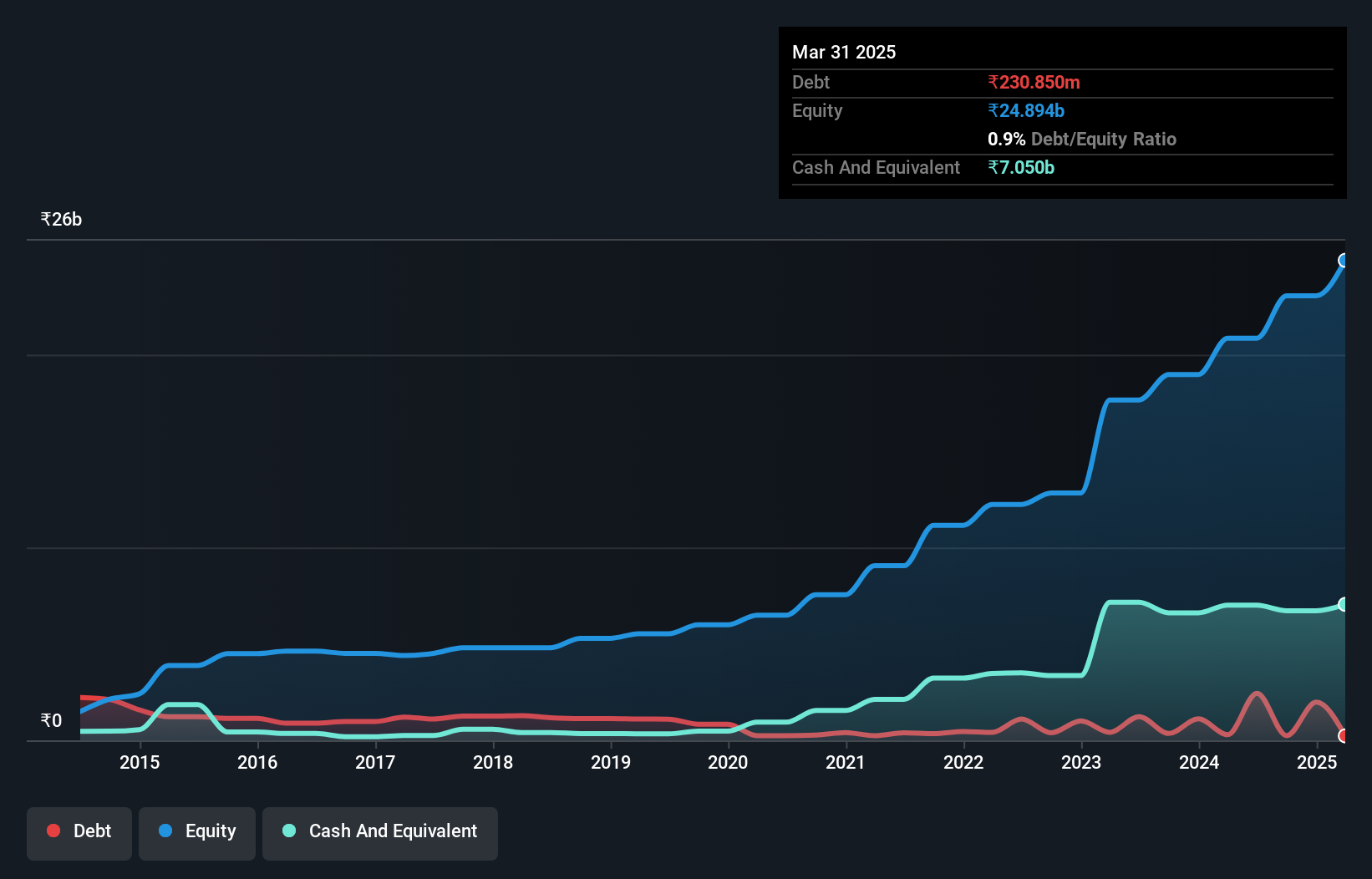

Marksans Pharma, a small-cap player in the pharmaceuticals sector, has shown robust performance with earnings growing 21.7% over the past year. Trading at a P/E ratio of 37.7x, it is attractively valued compared to industry peers averaging 42.8x. The company's debt to equity ratio has improved from 19.9% to 11.7% in five years, and its interest payments are well covered by EBIT at 32.2x coverage. Recent USFDA inspection closure adds credibility to its operations.

- Click here and access our complete health analysis report to understand the dynamics of Marksans Pharma.

Examine Marksans Pharma's past performance report to understand how it has performed in the past.

Zaggle Prepaid Ocean Services (NSEI:ZAGGLE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zaggle Prepaid Ocean Services Limited develops financial products and solutions to manage business expenses for corporates, SMEs, and startups through automated workflows, with a market cap of ₹53.57 billion.

Operations: The company generates revenue primarily from Program Fees (₹4.01 billion), Propel Platform Revenue/Gift Cards (₹4.76 billion), and Platform/SaaS/Service Fees (₹326.27 million).

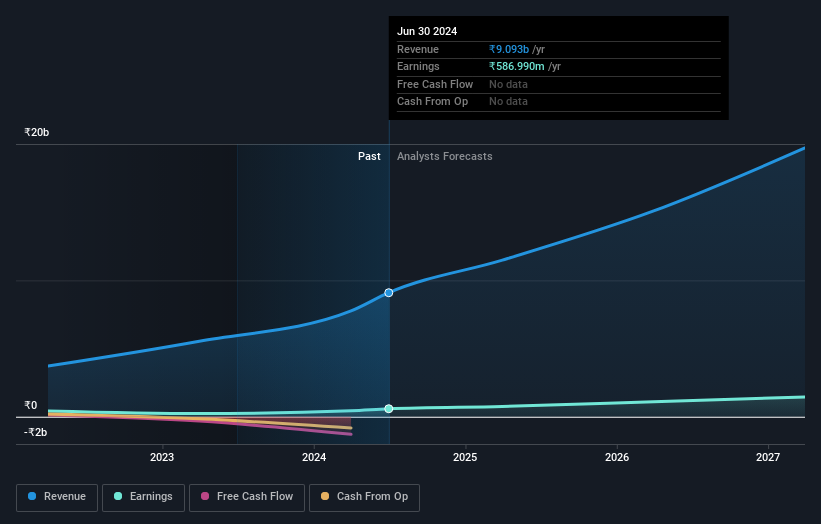

Zaggle Prepaid Ocean Services has shown impressive growth, with earnings increasing by 108.5% over the past year, far outpacing the Software industry's 32.4%. The company’s EBIT covers its interest payments by a robust 31.5 times, indicating strong financial health. Recent agreements with HDFC ERGO and Blue Star Ltd highlight its expanding client base and service offerings. Zaggle's net income for Q1 2024 was INR 167 million compared to INR 21 million a year ago, showcasing significant profitability improvements.

Turning Ideas Into Actions

- Take a closer look at our Indian Undiscovered Gems With Strong Fundamentals list of 488 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zaggle Prepaid Ocean Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ZAGGLE

Zaggle Prepaid Ocean Services

Zaggle Prepaid Ocean Services Limited builds financial products and solutions to manage the business expenses of corporates, small and medium-sized enterprises, and startups through automated workflows.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)