ICICI Prudential Life Insurance Company Limited's (NSE:ICICIPRULI) Shares May Have Run Too Fast Too Soon

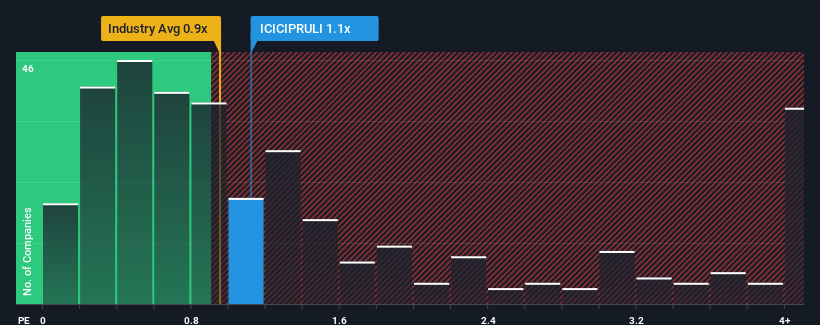

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Insurance industry in India, you could be forgiven for feeling indifferent about ICICI Prudential Life Insurance Company Limited's (NSE:ICICIPRULI) P/S ratio of 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for ICICI Prudential Life Insurance

How Has ICICI Prudential Life Insurance Performed Recently?

Recent times have been advantageous for ICICI Prudential Life Insurance as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think ICICI Prudential Life Insurance's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like ICICI Prudential Life Insurance's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 52%. The strong recent performance means it was also able to grow revenue by 41% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 13% each year as estimated by the analysts watching the company. Meanwhile, the broader industry is forecast to expand by 6.7% per annum, which paints a poor picture.

With this information, we find it concerning that ICICI Prudential Life Insurance is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On ICICI Prudential Life Insurance's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of ICICI Prudential Life Insurance's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with ICICI Prudential Life Insurance, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ICICIPRULI

ICICI Prudential Life Insurance

Provides life insurance, pension, and health insurance products to individuals and groups in India.

Mediocre balance sheet with limited growth.