Did ICICI Prudential Life Insurance's (NSE:ICICIPRULI) Share Price Deserve to Gain 19%?

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the ICICI Prudential Life Insurance Company Limited (NSE:ICICIPRULI) share price is up 19% in the last three years, clearly besting the market return of around 3.2% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 1.7% in the last year.

Check out our latest analysis for ICICI Prudential Life Insurance

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last three years, ICICI Prudential Life Insurance failed to grow earnings per share, which fell 14% (annualized).

So we doubt that the market is looking to EPS for its main judge of the company's value. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

You can only imagine how long term shareholders feel about the declining revenue trend (slipping at 4.0% per year). What's clear is that historic earnings and revenue aren't matching up with the share price action, very well. So you might have to dig deeper to get a grasp of the situation

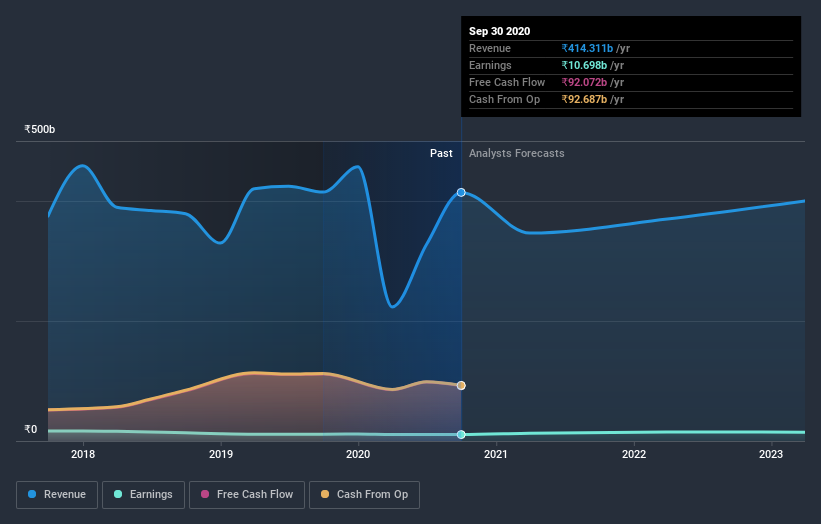

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

ICICI Prudential Life Insurance is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We've already covered ICICI Prudential Life Insurance's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. ICICI Prudential Life Insurance's TSR of 21% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

ICICI Prudential Life Insurance shareholders are up 1.7% for the year. While you don't go broke making a profit, this return was actually lower than the average market return of about 20%. At least the longer term returns (running at about 7% a year, are better. We prefer focus on longer term returns, as they are usually a more meaningful indication of the underlying business. It's always interesting to track share price performance over the longer term. But to understand ICICI Prudential Life Insurance better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with ICICI Prudential Life Insurance , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade ICICI Prudential Life Insurance, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ICICIPRULI

ICICI Prudential Life Insurance

Provides life insurance, pension, and health insurance products to individuals and groups in India.

Mediocre balance sheet with limited growth.