- India

- /

- Personal Products

- /

- NSEI:EMAMILTD

We Ran A Stock Scan For Earnings Growth And Emami (NSE:EMAMILTD) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Emami (NSE:EMAMILTD). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Emami with the means to add long-term value to shareholders.

View our latest analysis for Emami

How Quickly Is Emami Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, Emami has achieved impressive annual EPS growth of 42%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

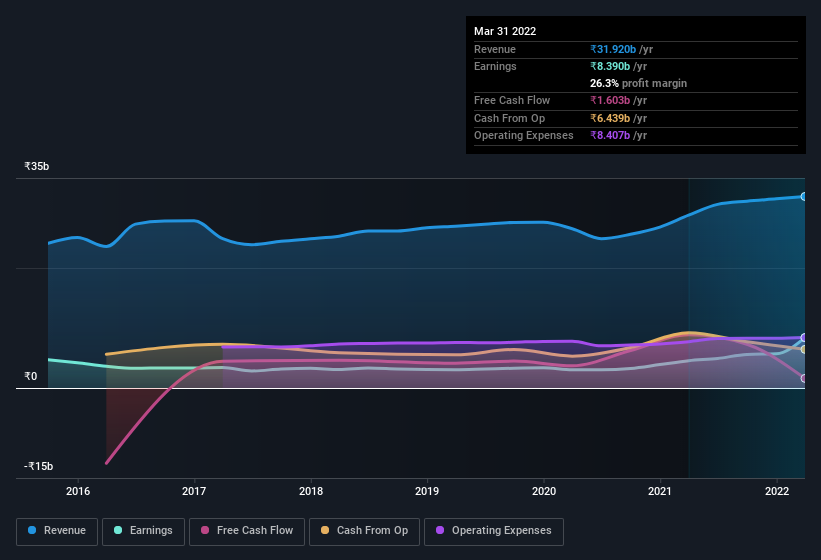

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Emami maintained stable EBIT margins over the last year, all while growing revenue 11% to ₹32b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Emami's future EPS 100% free.

Are Emami Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Emami shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at ₹15b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Emami with market caps between ₹160b and ₹511b is about ₹51m.

Emami's CEO only received compensation totalling ₹121k in the year to March 2021. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Emami To Your Watchlist?

Emami's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Emami is certainly doing some things right and is well worth investigating. However, before you get too excited we've discovered 2 warning signs for Emami (1 is a bit unpleasant!) that you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Emami, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emami might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EMAMILTD

Emami

Manufactures and markets personal and healthcare products in India and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives