- Hong Kong

- /

- Auto Components

- /

- SEHK:1899

Exploring 3 Undervalued Small Caps With Insider Activity Across Regions

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by volatility and sector-specific movements as investors react to the incoming Trump administration's policy signals and economic data, such as inflation rates and interest rate expectations. The S&P 600 for small-cap stocks has experienced fluctuations amid these broader market sentiments, highlighting the potential opportunities within this segment for those looking to navigate current economic uncertainties. In this context, identifying small-cap stocks with strong fundamentals and notable insider activity can be a strategic approach for investors seeking value in today's dynamic environment.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 24.0x | 0.8x | 28.70% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 48.16% | ★★★★★☆ |

| Capital Bancorp | 14.4x | 3.0x | 47.12% | ★★★★☆☆ |

| Avia Avian | 16.4x | 3.8x | 10.30% | ★★★★☆☆ |

| NCL Industries | 15.0x | 0.5x | -83.38% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 20.7x | 0.7x | 29.75% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 13.5x | 1.6x | -34.62% | ★★★☆☆☆ |

| Tai Sin Electric | 12.1x | 0.4x | 15.75% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Genus | 136.7x | 1.6x | 29.51% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Shalby (NSEI:SHALBY)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Shalby operates primarily in the healthcare sector, providing healthcare services and manufacturing implants, with a market capitalization of ₹13.25 billion.

Operations: Shalby generates revenue primarily from healthcare services and the manufacturing of implants, with healthcare services contributing significantly more. The company's cost structure is dominated by the cost of goods sold (COGS), which affects its gross profit margin. Over recent periods, the gross profit margin has shown variability, reaching as high as 28.44% in June 2024 and dropping to 24.39% by September 2024.

PE: 42.4x

Shalby, operating in a dynamic healthcare sector, presents itself as a potentially undervalued opportunity. Recent earnings showed sales growth to INR 2,675.39 million for Q2 2024 from INR 2,379.84 million the previous year, though net income fell significantly to INR 33.94 million from INR 275.83 million. Despite this dip in profitability and reliance on external borrowing for funding, insider confidence is evident with recent share purchases by executives over the past months. The company’s forecasted earnings growth rate of nearly 60% annually suggests potential upside if operational efficiencies improve and external conditions stabilize further enhancing its small-cap appeal amidst market volatility.

- Navigate through the intricacies of Shalby with our comprehensive valuation report here.

Gain insights into Shalby's historical performance by reviewing our past performance report.

Norva24 Group (OM:NORVA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Norva24 Group specializes in providing underground infrastructure maintenance services across Northern Europe, with a market capitalization of approximately NOK 2.34 billion.

Operations: Norva24 Group generates revenue primarily through its core operations, with a significant portion of costs attributed to COGS and operating expenses. Over recent periods, the company has experienced fluctuations in its gross profit margin, which was 47.08% as of September 30, 2024. Notably, the net income margin reached 7.19% by December 31, 2023.

PE: 24.9x

Norva24 Group's recent earnings report shows a rise in sales to NOK 963.2 million for Q3 2024, up from NOK 785.1 million the previous year, though net income dipped to NOK 49 million from NOK 70.4 million. Despite this, insider confidence is evident with share purchases over the past year, signaling belief in future growth prospects. The company relies entirely on external borrowing for funding, which poses higher risk but suggests potential for significant expansion given its forecasted earnings growth of 21% annually.

- Click to explore a detailed breakdown of our findings in Norva24 Group's valuation report.

Evaluate Norva24 Group's historical performance by accessing our past performance report.

Xingda International Holdings (SEHK:1899)

Simply Wall St Value Rating: ★★★☆☆☆

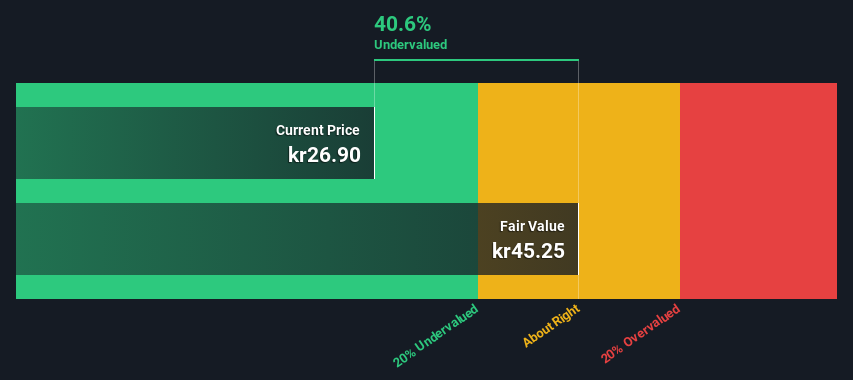

Overview: Xingda International Holdings is a company engaged in the production and distribution of radial tire cords, bead wires, and other wires, with a market capitalization of approximately HK$2.39 billion.

Operations: The primary revenue stream for the company is from Radial Tire Cords, Bead Wires and Other Wires, with recent revenues reaching CN¥12.24 billion. The cost of goods sold (COGS) has been substantial, amounting to CN¥9.86 billion in the latest period. Notably, the net income margin has shown some fluctuation over time but recently stands at 3.67%.

PE: 5.2x

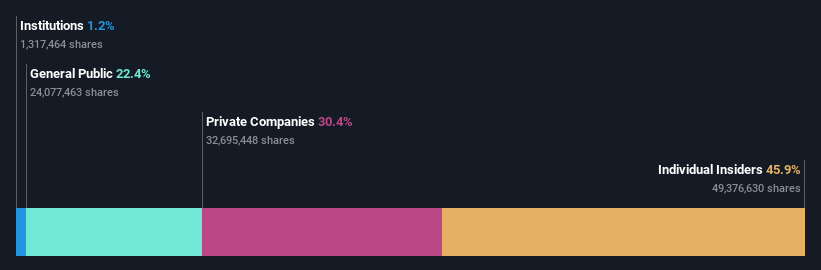

Xingda International Holdings, a company with a market value under HK$10 billion, recently attracted insider confidence as Liu Jinlan proposed acquiring an additional 62.97% stake for HK$1.6 billion in September 2024. The company's financials show stable performance with sales reaching CNY 6,165 million for the first half of 2024 and net income remaining steady at CNY 192 million year-over-year. Despite higher-risk funding sources, it maintains a solid financial position without shareholder dilution over the past year.

- Unlock comprehensive insights into our analysis of Xingda International Holdings stock in this valuation report.

Understand Xingda International Holdings' track record by examining our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 176 Undervalued Small Caps With Insider Buying by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1899

Xingda International Holdings

An investment holding company, manufactures and trades in radial tire cords, bead wires, and other wires in the People's Republic of China, India, the United States, Thailand, Korea, Slovakia, Brazil, and internationally.

Solid track record, good value and pays a dividend.