- India

- /

- Healthcare Services

- /

- NSEI:LOTUSEYE

If EPS Growth Is Important To You, Lotus Eye Hospital and Institute (NSE:LOTUSEYE) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Lotus Eye Hospital and Institute (NSE:LOTUSEYE). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Lotus Eye Hospital and Institute

How Fast Is Lotus Eye Hospital and Institute Growing Its Earnings Per Share?

Lotus Eye Hospital and Institute has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Lotus Eye Hospital and Institute's EPS shot from ₹0.75 to ₹1.44, over the last year. Year on year growth of 90% is certainly a sight to behold.

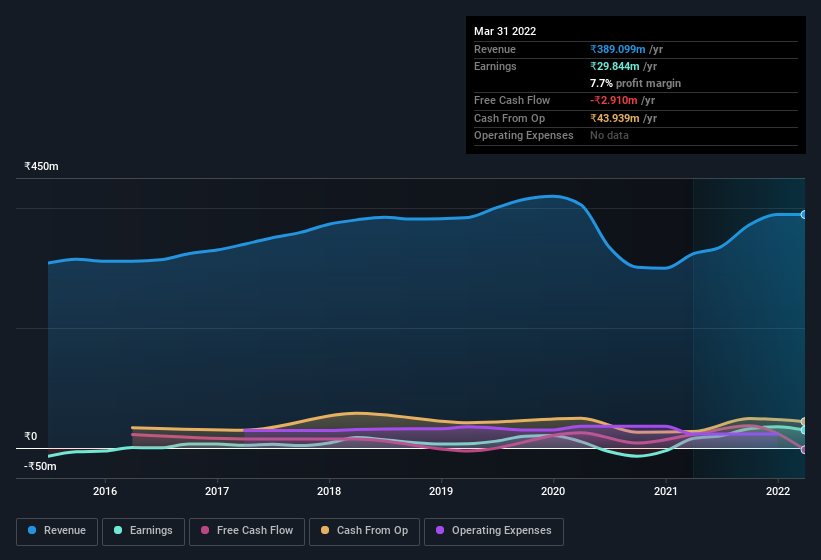

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Lotus Eye Hospital and Institute shareholders can take confidence from the fact that EBIT margins are up from 4.5% to 8.6%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Lotus Eye Hospital and Institute is no giant, with a market capitalisation of ₹891m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Lotus Eye Hospital and Institute Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Lotus Eye Hospital and Institute insiders own a meaningful share of the business. Indeed, with a collective holding of 65%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Of course, Lotus Eye Hospital and Institute is a very small company, with a market cap of only ₹891m. So this large proportion of shares owned by insiders only amounts to ₹583m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations under ₹16b, like Lotus Eye Hospital and Institute, the median CEO pay is around ₹3.0m.

The CEO of Lotus Eye Hospital and Institute was paid just ₹678k in total compensation for the year ending March 2021. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Lotus Eye Hospital and Institute To Your Watchlist?

Lotus Eye Hospital and Institute's earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Lotus Eye Hospital and Institute certainly ticks a few boxes, so we think it's probably well worth further consideration. We don't want to rain on the parade too much, but we did also find 4 warning signs for Lotus Eye Hospital and Institute that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LOTUSEYE

Lotus Eye Hospital and Institute

A specialty eye care hospital, provides eye care and related services in India.

Excellent balance sheet and slightly overvalued.