With EPS Growth And More, Zydus Wellness (NSE:ZYDUSWELL) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Zydus Wellness (NSE:ZYDUSWELL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Zydus Wellness with the means to add long-term value to shareholders.

Check out our latest analysis for Zydus Wellness

How Fast Is Zydus Wellness Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Zydus Wellness grew its EPS by 6.5% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

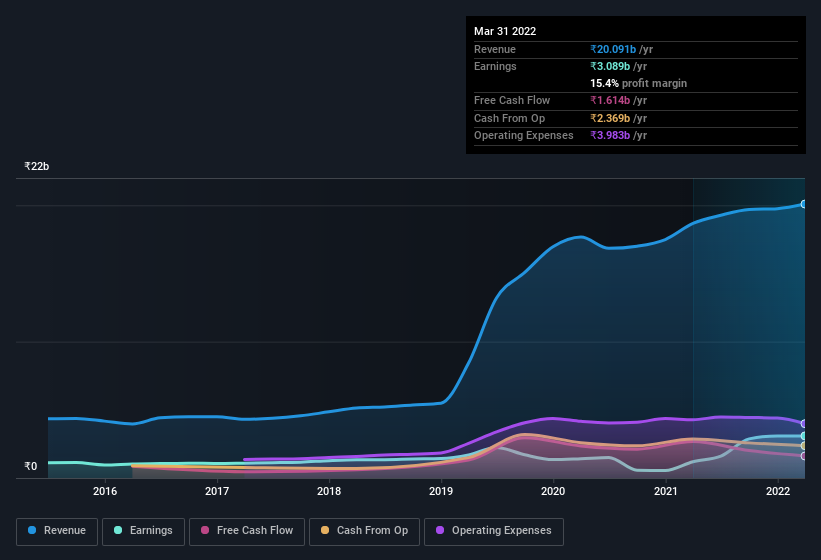

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Zydus Wellness maintained stable EBIT margins over the last year, all while growing revenue 7.6% to ₹20b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Zydus Wellness' forecast profits?

Are Zydus Wellness Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth ₹2.3m) this was overshadowed by a mountain of buying, totalling ₹298m in just one year. We find this encouraging because it suggests they are optimistic about Zydus Wellness'future. We also note that it was the company insider, Pankaj Patel, who made the biggest single acquisition, paying ₹134m for shares at about ₹1,523 each.

On top of the insider buying, it's good to see that Zydus Wellness insiders have a valuable investment in the business. Given insiders own a significant chunk of shares, currently valued at ₹7.3b, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Tarun Arora, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Zydus Wellness, with market caps between ₹78b and ₹250b, is around ₹36m.

The CEO of Zydus Wellness only received ₹13m in total compensation for the year ending March 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Zydus Wellness To Your Watchlist?

One positive for Zydus Wellness is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. If you think Zydus Wellness might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Keen growth investors love to see insider buying. Thankfully, Zydus Wellness isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zydus Wellness might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZYDUSWELL

Zydus Wellness

Engages in the development, production, marketing, and distribution of health and wellness products in India, the Middle East, Asia, Africa, the Oceania, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives