The Sensex and the Nifty 50, key indices of the Indian stock market, hit fresh record highs in intraday trade on Friday, August 30. The BSE Midcap and Smallcap indices also rose almost a percent each, driven by expectations of a rate cut and solid economic growth amid a healthy monsoon. In this thriving market environment, identifying stocks with strong fundamentals and growth potential becomes crucial. Here are three undiscovered gems in India that stand out as promising opportunities to watch this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Kalyani Investment | NA | 20.74% | 6.35% | ★★★★★☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 20.01% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

ASK Automotive (NSEI:ASKAUTOLTD)

Simply Wall St Value Rating: ★★★★☆☆

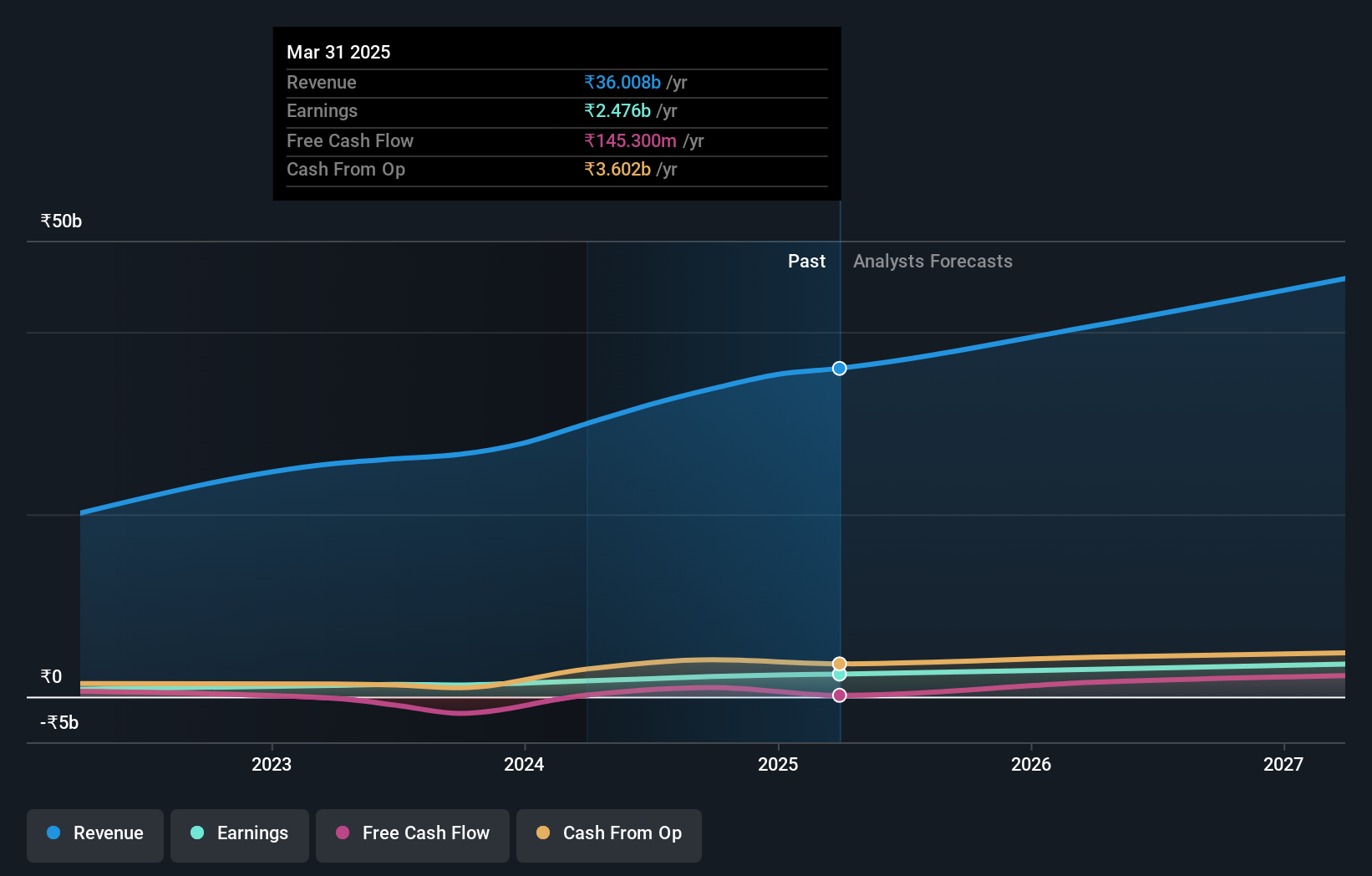

Overview: ASK Automotive Limited, through its subsidiary, manufactures and sells auto components for the automobile industry in India and has a market cap of ₹90.35 billion.

Operations: ASK Automotive Limited generates revenue primarily from the manufacturing of auto components, amounting to ₹32.00 billion. The company has a market cap of ₹90.35 billion.

ASK Automotive, a small-cap player in India's auto components sector, has shown robust earnings growth of 44.8% over the past year, outpacing the industry average of 20.1%. The company's net debt to equity ratio stands at 40.8%, which is high but manageable given its EBIT covers interest payments by 8.6 times. Recent Q1 results highlight strong performance with net income rising to INR 568 million from INR 348 million last year and EPS increasing to INR 2.88 from INR 1.77

- Unlock comprehensive insights into our analysis of ASK Automotive stock in this health report.

Gain insights into ASK Automotive's past trends and performance with our Past report.

Aurionpro Solutions (NSEI:AURIONPRO)

Simply Wall St Value Rating: ★★★★★★

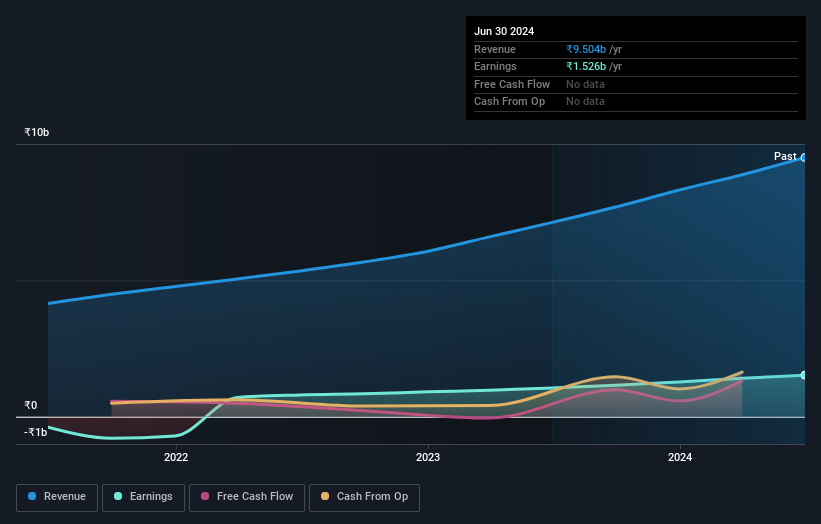

Overview: Aurionpro Solutions Limited offers technology solutions in transaction banking, customer experience, smart city, and smart transportation sectors in India and globally, with a market cap of ₹103.87 billion.

Operations: Aurionpro Solutions Limited generates revenue primarily through the sale of software services (₹6.30 billion) and the sale of equipment and product licenses (₹3.21 billion).

Aurionpro Solutions, a promising player in India's tech sector, has demonstrated robust growth with earnings surging 44.5% over the past year, outpacing the software industry's 28.6%. The company's debt to equity ratio improved from 16.9% to 8.6% over five years, showcasing prudent financial management. Recently winning a $3 million deal with a Malaysian bank highlights its strategic expansion and technological prowess in commercial lending solutions like SmartLender, further cementing its industry leadership.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

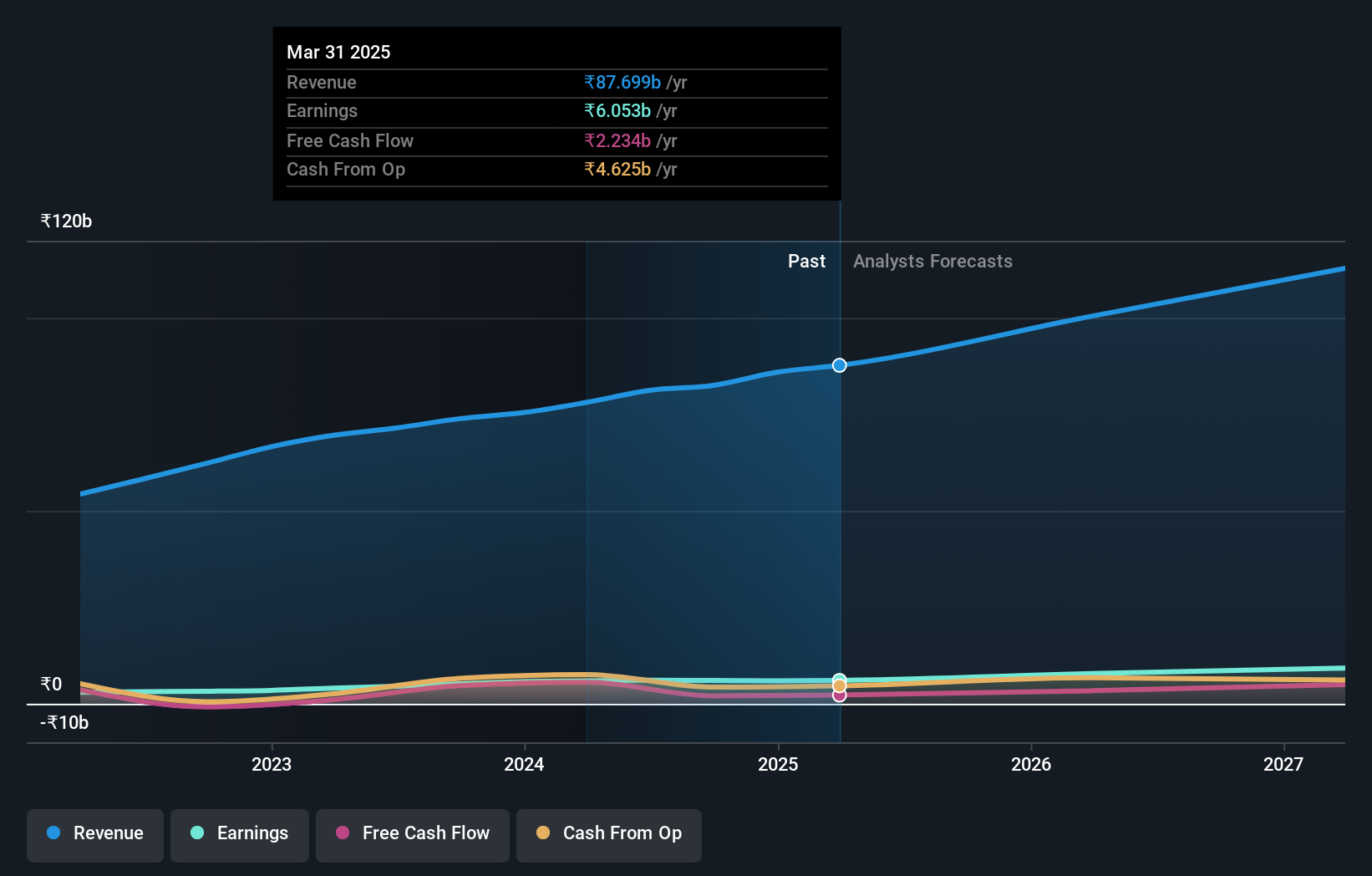

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market cap of ₹128.43 billion.

Operations: The primary revenue stream for LT Foods Limited is the manufacture and storage of rice, generating ₹81.21 billion. The company focuses on branded and non-branded basmati rice and rice food products in India.

LT Foods has shown impressive financial performance with earnings growing 35.7% over the past year, outpacing the Food industry’s 15%. Trading at a P/E ratio of 21x, it offers good value compared to the Indian market's 34.6x. The company’s debt-to-equity ratio improved significantly from 116.4% to 26.8% in five years, and its interest payments are well covered by EBIT at a multiple of 10.8x, indicating strong financial health and future growth potential.

- Delve into the full analysis health report here for a deeper understanding of LT Foods.

Gain insights into LT Foods' historical performance by reviewing our past performance report.

Key Takeaways

- Take a closer look at our Indian Undiscovered Gems With Strong Fundamentals list of 472 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:AURIONPRO

Aurionpro Solutions

Provides technology solutions in the transaction banking platform, customer experience, smart city, and smart transportation areas in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives