The Indian market has shown remarkable resilience, with a 45% increase over the past year and a notable 4.7% gain in the Communication Services sector just last week. In this thriving environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Kalyani Investment | NA | 20.74% | 6.35% | ★★★★★☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 20.01% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Aurionpro Solutions (NSEI:AURIONPRO)

Simply Wall St Value Rating: ★★★★★★

Overview: Aurionpro Solutions Limited offers technology solutions in transaction banking, customer experience, smart city, and smart transportation sectors across India and internationally, with a market cap of ₹103.87 billion.

Operations: Aurionpro Solutions Limited generates revenue primarily from the sale of software services (₹6.30 billion) and equipment/product licenses (₹3.21 billion).

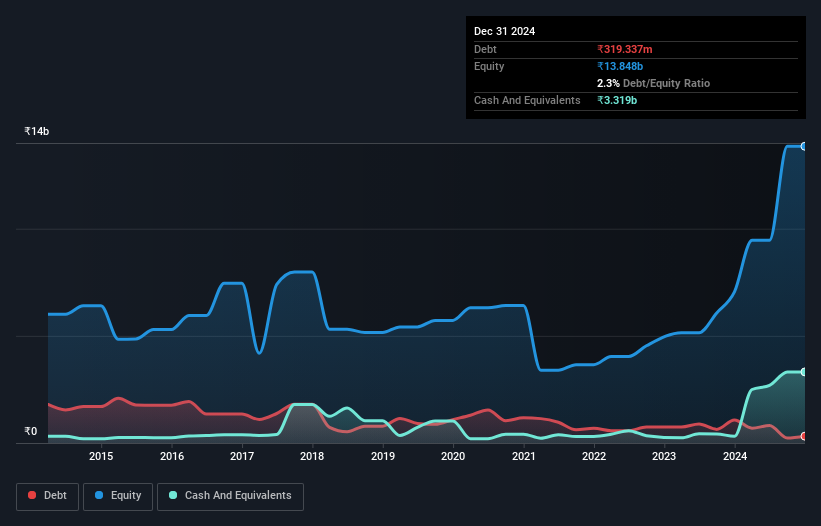

Aurionpro Solutions has shown impressive earnings growth of 44.5% over the past year, outpacing the software industry's 28.6%. Its debt to equity ratio has improved from 16.9% to 8.6% in five years, and it holds more cash than total debt, ensuring financial stability. Recent strategic wins include a $3 million deal with a leading Malaysian bank to modernize corporate processes using its SmartLender solution, further cementing its market position in Asia's commercial lending sector.

- Navigate through the intricacies of Aurionpro Solutions with our comprehensive health report here.

Examine Aurionpro Solutions' past performance report to understand how it has performed in the past.

EMS (NSEI:EMSLIMITED)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EMS Limited constructs, designs, and installs water, wastewater, and domestic waste treatment facilities with a market cap of ₹47.63 billion.

Operations: EMS Limited generates revenue primarily from its waste management segment, amounting to ₹8.62 billion.

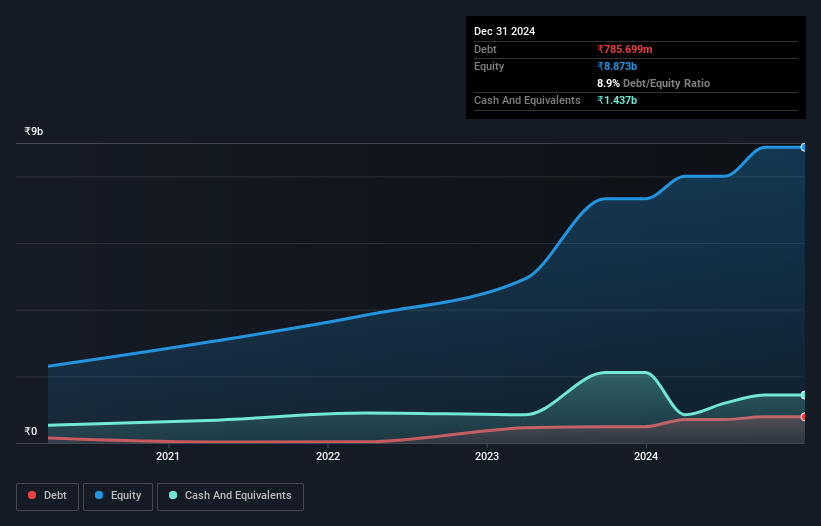

EMS Limited has been making waves with earnings growth of 51.9% over the past year, far outpacing the Commercial Services industry’s 18.6%. The company reported Q1 2025 sales at INR 2.06 billion, up from INR 1.38 billion a year ago, and net income rose to INR 371 million from INR 227 million. With a P/E ratio of 28.6x below the Indian market average of 34.6x and high-quality earnings, EMS remains an intriguing prospect despite its volatile share price recently.

- Click to explore a detailed breakdown of our findings in EMS' health report.

Explore historical data to track EMS' performance over time in our Past section.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market cap of ₹128.43 billion.

Operations: LT Foods generates revenue primarily from the manufacture and storage of rice, amounting to ₹81.21 billion.

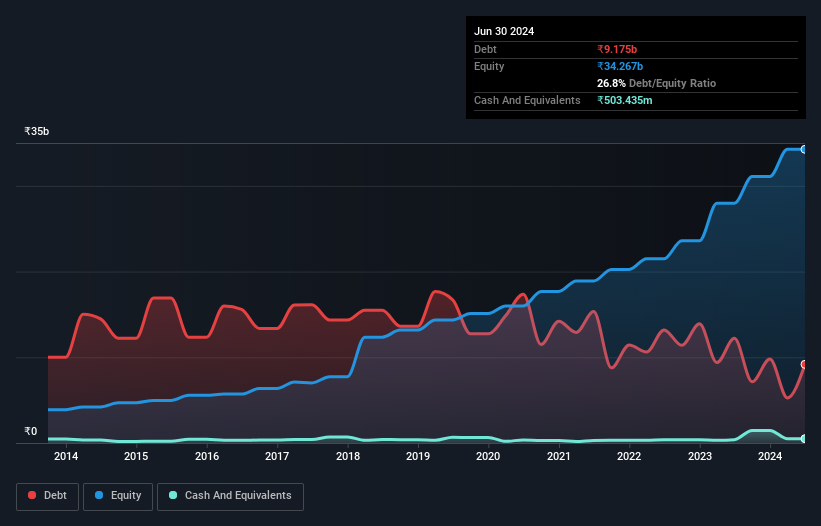

LT Foods has shown robust financial health with its debt to equity ratio dropping significantly from 116.4% to 26.8% over five years. The company's earnings grew by 35.7% last year, outpacing the food industry's average of 15%. Trading at a price-to-earnings ratio of 21x, it is well below the Indian market's average of 34.6x, indicating good value relative to peers and industry standards. EBIT covers interest payments comfortably at a rate of 10.8 times.

Make It Happen

- Click through to start exploring the rest of the 469 Indian Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:AURIONPRO

Aurionpro Solutions

Provides technology solutions in the transaction banking platform, customer experience, smart city, and smart transportation areas in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives