- India

- /

- Tech Hardware

- /

- NSEI:NETWEB

Emerging Indian Stocks To Watch In September 2024

Reviewed by Simply Wall St

The Indian market has been flat over the last week but is up 43% over the past year, with earnings forecast to grow by 17% annually. In this dynamic environment, identifying stocks with strong growth potential and solid fundamentals can be key to capitalizing on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Kaycee Industries | 17.35% | 19.50% | 34.62% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited is involved in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market cap of ₹140.53 billion.

Operations: LT Foods generates revenue primarily from the manufacture and storage of rice, amounting to ₹81.21 billion. The company focuses on branded and non-branded basmati rice products within India.

LT Foods, a promising player in India's food sector, has seen its debt to equity ratio fall from 116.4% to 26.8% over five years. Trading at a P/E ratio of 23x, it offers good value compared to the Indian market's 34.2x. The company’s earnings grew by 35.7% last year and outpaced the industry average of 15%. Recent board meetings discussed acquiring stakes in Nature Bio-Foods Limited, indicating strategic growth plans ahead.

- Take a closer look at LT Foods' potential here in our health report.

Review our historical performance report to gain insights into LT Foods''s past performance.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of ₹155.07 billion.

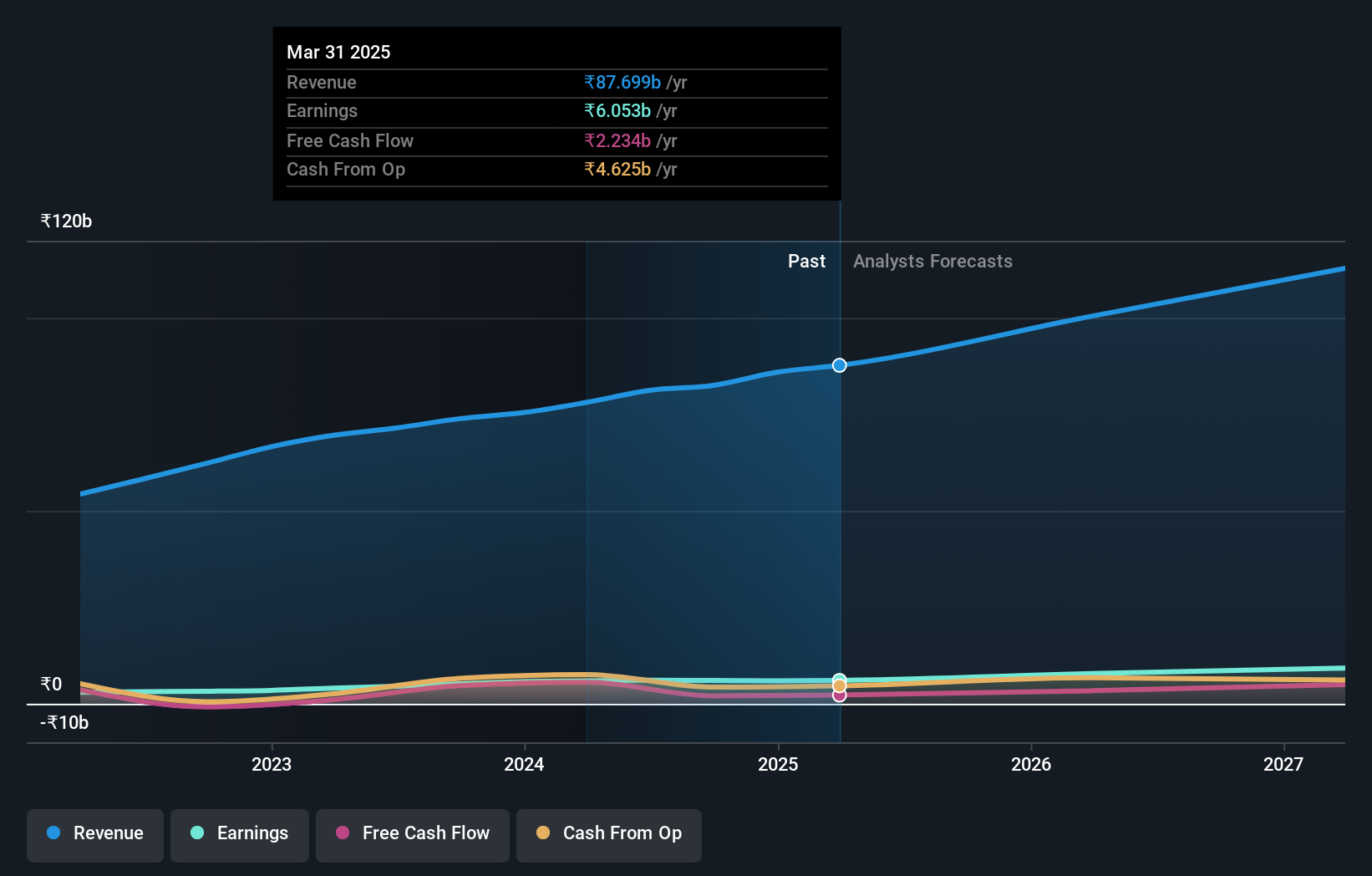

Operations: Netweb Technologies India Limited generates revenue primarily from the manufacturing and sale of computer servers, amounting to ₹8.14 billion.

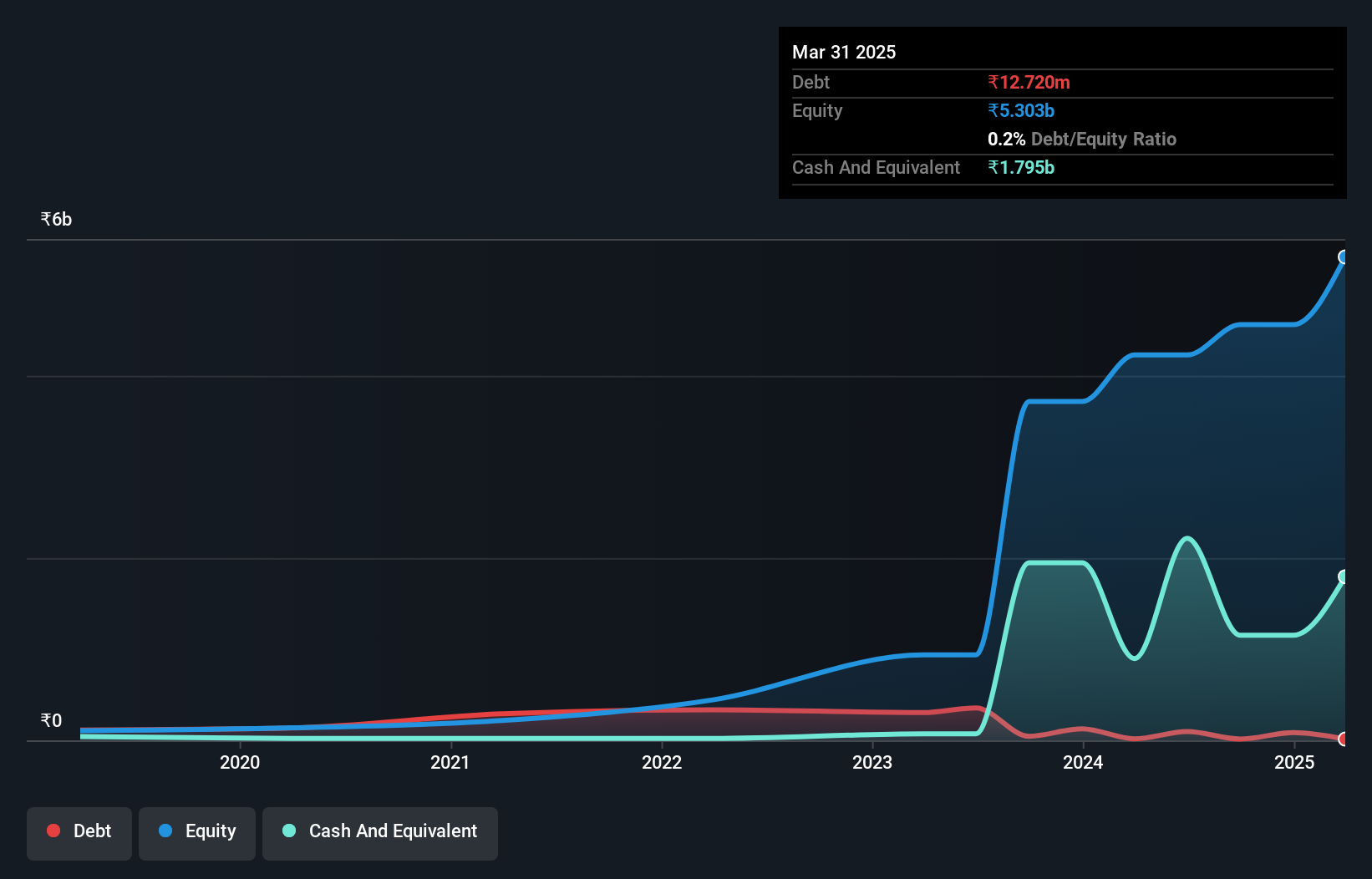

Netweb Technologies India has showcased impressive earnings growth of 85.8% over the past year, surpassing the Tech industry's 10.5%. The company’s debt to equity ratio improved significantly from 108% to 2.3% in five years, demonstrating better financial health. Recent product launches like the Tyrone Camarero SDA200A2N-212 and others cater to both domestic and international markets, emphasizing innovation in advanced server systems. Net income for Q1 2024 was INR 154 million compared to INR 51 million last year, reflecting robust performance.

- Unlock comprehensive insights into our analysis of Netweb Technologies India stock in this health report.

Learn about Netweb Technologies India's historical performance.

Sundaram Finance Holdings (NSEI:SUNDARMHLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sundaram Finance Holdings Limited engages in investments, business processing, and support services across India, Australia, and the United Kingdom with a market cap of ₹93.19 billion.

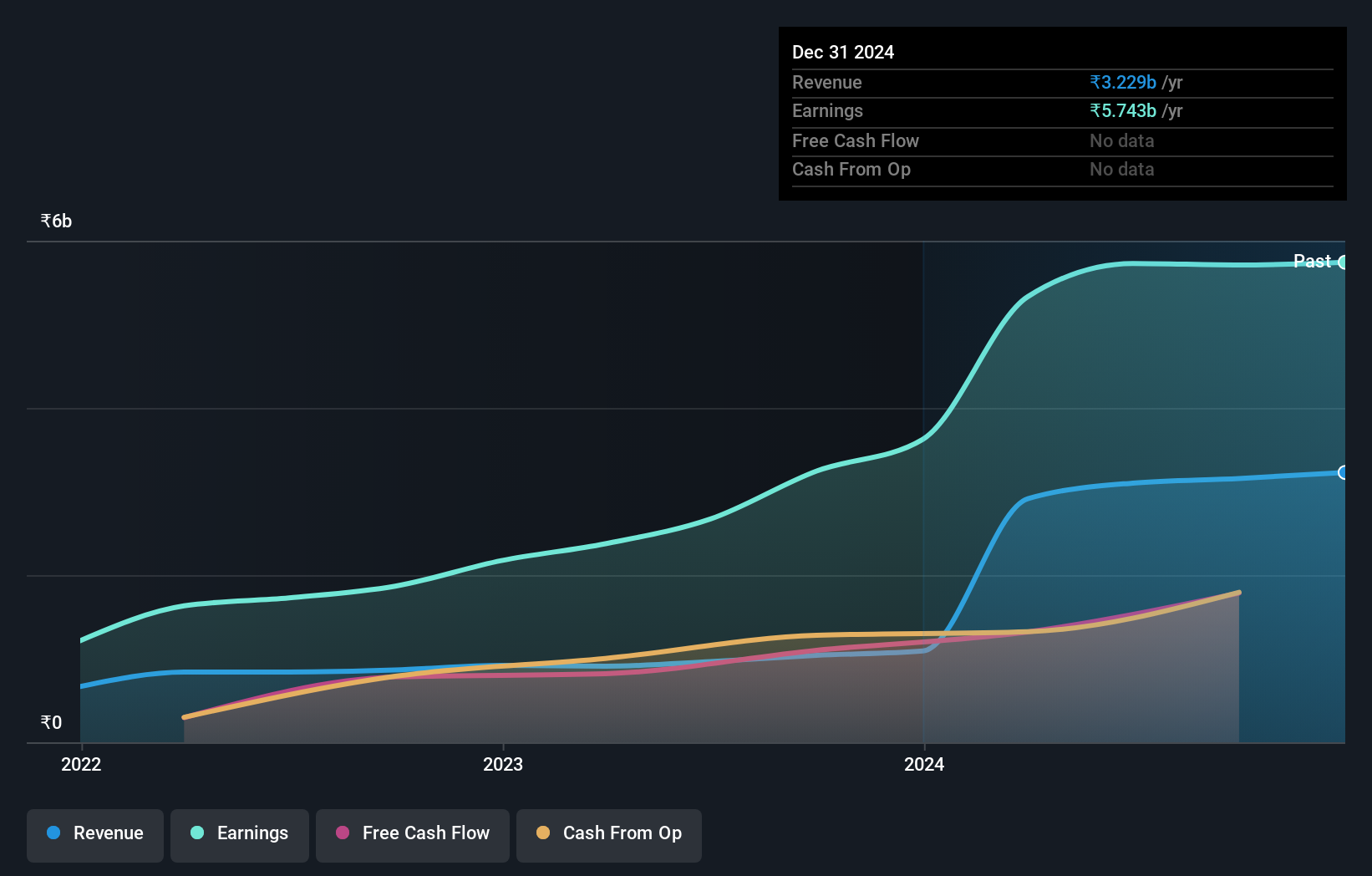

Operations: Sundaram Finance Holdings Limited generates revenue primarily from investments, which contribute ₹2.51 billion, followed by shared services in overseas markets at ₹489.78 million, and domestic shared services at ₹105.51 million. The company has a market cap of ₹93.19 billion.

Sundaram Finance Holdings has shown impressive growth, with earnings increasing by 114.5% over the past year, outpacing the Auto Components industry’s 20.1%. The company reported first-quarter revenue of INR 442.78 million and net income of INR 1.10 billion, up from INR 252.88 million and INR 706.72 million, respectively, a year ago. With a price-to-earnings ratio of 16.3x below the Indian market average of 34.2x and interest payments covered by EBIT at an astonishing rate of 265 times, it appears financially robust despite recent share price volatility.

- Click to explore a detailed breakdown of our findings in Sundaram Finance Holdings' health report.

Understand Sundaram Finance Holdings' track record by examining our Past report.

Turning Ideas Into Actions

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 471 more companies for you to explore.Click here to unveil our expertly curated list of 474 Indian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netweb Technologies India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NETWEB

Netweb Technologies India

Designs, manufactures, and sells high-end computing solutions (HCS) in India.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives