With EPS Growth And More, Kriti Nutrients (NSE:KRITINUT) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Kriti Nutrients (NSE:KRITINUT). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Kriti Nutrients

How Quickly Is Kriti Nutrients Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Impressively, Kriti Nutrients has grown EPS by 28% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

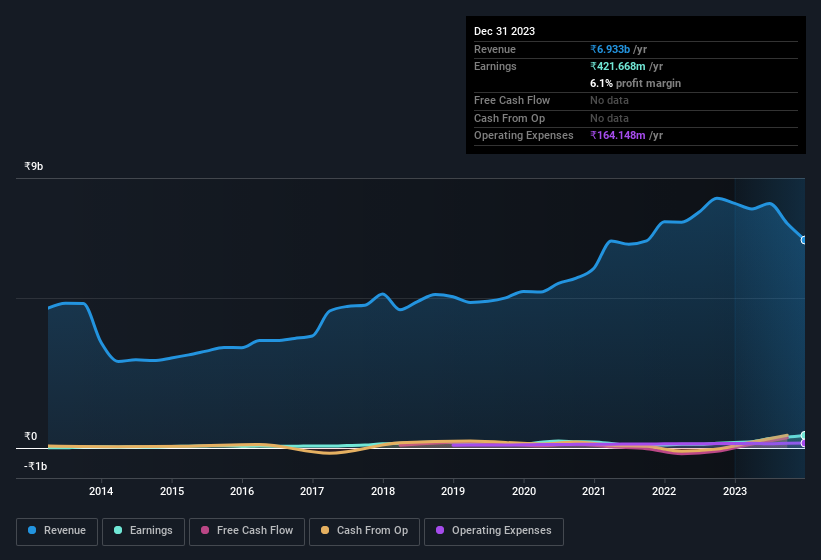

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. We note that while EBIT margins have improved from 3.0% to 7.8%, the company has actually reported a fall in revenue by 15%. That's not a good look.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Kriti Nutrients is no giant, with a market capitalisation of ₹4.8b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Kriti Nutrients Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Kriti Nutrients insiders refrain from selling stock during the year, but they also spent ₹8.5m buying it. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Director Purnima Mehta for ₹3.5m worth of shares, at about ₹54.20 per share.

Is Kriti Nutrients Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Kriti Nutrients' strong EPS growth. Not only is that growth rate rather juicy, but the insider buying adds fuel to the fire. In essence, your time will not be wasted checking out Kriti Nutrients in more detail. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Kriti Nutrients , and understanding them should be part of your investment process.

The good news is that Kriti Nutrients is not the only growth stock with insider buying. Here's a list of growth-focused companies in IN with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kriti Nutrients might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KRITINUT

Kriti Nutrients

Manufactures and sells soyabean seeds under the Kriti brand in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives