- India

- /

- Oil and Gas

- /

- NSEI:HINDPETRO

The Market Doesn't Like What It Sees From Hindustan Petroleum Corporation Limited's (NSE:HINDPETRO) Revenues Yet

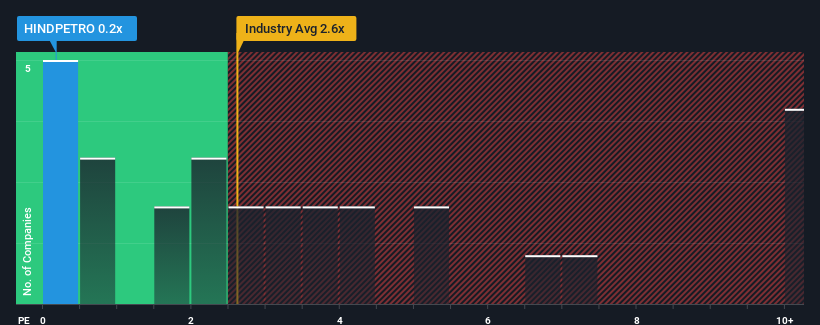

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Hindustan Petroleum Corporation Limited (NSE:HINDPETRO) is definitely a stock worth checking out, seeing as almost half of all the Oil and Gas companies in India have P/S ratios greater than 2.6x and even P/S above 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Hindustan Petroleum

What Does Hindustan Petroleum's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Hindustan Petroleum's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Hindustan Petroleum's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Hindustan Petroleum would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 1.6% decrease to the company's top line. Still, the latest three year period has seen an excellent 86% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 0.4% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 6.0% per annum.

With this in consideration, we find it intriguing that Hindustan Petroleum's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Hindustan Petroleum's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Hindustan Petroleum's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Hindustan Petroleum's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Hindustan Petroleum (1 is concerning!) that you should be aware of.

If you're unsure about the strength of Hindustan Petroleum's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Petroleum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HINDPETRO

Hindustan Petroleum

Engages in the refining and marketing of petroleum products in India and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives