- India

- /

- Capital Markets

- /

- NSEI:THEINVEST

Investment Trust of India's(NSE:THEINVEST) Share Price Is Down 28% Over The Past Year.

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by The Investment Trust of India Limited (NSE:THEINVEST) shareholders over the last year, as the share price declined 28%. That contrasts poorly with the market decline of 1.9%. Investment Trust of India may have better days ahead, of course; we've only looked at a one year period. There was little comfort for shareholders in the last week as the price declined a further 3.3%.

Check out our latest analysis for Investment Trust of India

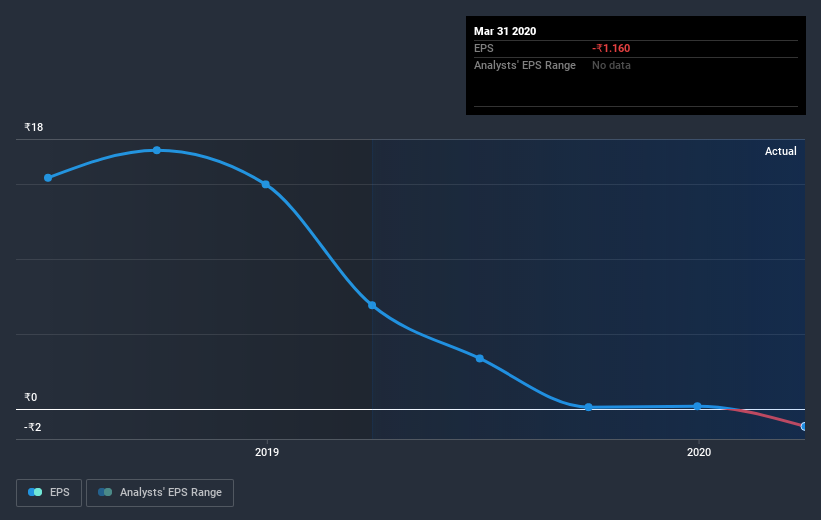

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Investment Trust of India fell to a loss making position during the year. Some investors no doubt dumped the stock as a result. Of course, if the company can turn the situation around, investors will likely profit.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Investment Trust of India's key metrics by checking this interactive graph of Investment Trust of India's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 1.9% in the last year, Investment Trust of India shareholders might be miffed that they lost 28%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 5.9% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Investment Trust of India has 2 warning signs we think you should be aware of.

But note: Investment Trust of India may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Investment Trust of India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Investment Trust of India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:THEINVEST

Investment Trust of India

Provides investment banking and corporate finance activities in India.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives