- India

- /

- Diversified Financial

- /

- NSEI:TFCILTD

Tourism Finance Corporation of India Limited's (NSE:TFCILTD) Share Price Boosted 27% But Its Business Prospects Need A Lift Too

Tourism Finance Corporation of India Limited (NSE:TFCILTD) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The annual gain comes to 172% following the latest surge, making investors sit up and take notice.

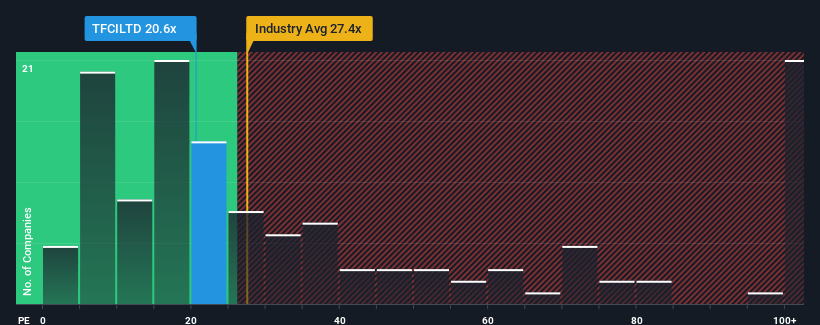

Even after such a large jump in price, Tourism Finance Corporation of India may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.6x, since almost half of all companies in India have P/E ratios greater than 33x and even P/E's higher than 64x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Tourism Finance Corporation of India has been doing a decent job lately as it's been growing earnings at a reasonable pace. One possibility is that the P/E is low because investors think this good earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

View our latest analysis for Tourism Finance Corporation of India

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Tourism Finance Corporation of India would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 3.6%. However, this wasn't enough as the latest three year period has seen an unpleasant 1.6% overall drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's an unpleasant look.

In light of this, it's understandable that Tourism Finance Corporation of India's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Tourism Finance Corporation of India's P/E

The latest share price surge wasn't enough to lift Tourism Finance Corporation of India's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Tourism Finance Corporation of India revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Tourism Finance Corporation of India (at least 1 which is significant), and understanding these should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tourism Finance Corporation of India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TFCILTD

Tourism Finance Corporation of India

A financing institution, provides financial assistance services in India.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives