- India

- /

- Diversified Financial

- /

- NSEI:RECLTD

REC Limited's (NSE:RECLTD) Share Price Boosted 27% But Its Business Prospects Need A Lift Too

Despite an already strong run, REC Limited (NSE:RECLTD) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 289% in the last year.

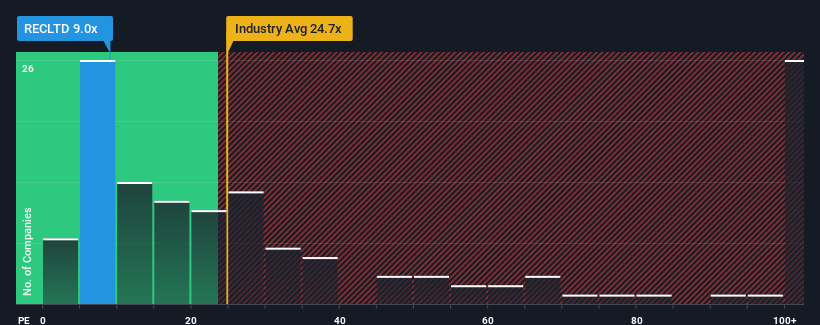

In spite of the firm bounce in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 30x, you may still consider REC as a highly attractive investment with its 9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, REC has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for REC

How Is REC's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like REC's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 24% last year. The strong recent performance means it was also able to grow EPS by 105% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 10% per year as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is noticeably more attractive.

In light of this, it's understandable that REC's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On REC's P/E

Even after such a strong price move, REC's P/E still trails the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of REC's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for REC you should be aware of, and 1 of them is significant.

You might be able to find a better investment than REC. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RECLTD

REC

Engages in the provision of financing services for power generation, transmission, and distribution projects in India.

Very undervalued average dividend payer.