- India

- /

- Diversified Financial

- /

- NSEI:LTF

L&T Finance Holdings (NSE:L&TFH) sheds ₹19b, company earnings and investor returns have been trending downwards for past five years

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the L&T Finance Holdings Limited (NSE:L&TFH) share price managed to fall 63% over five long years. That's an unpleasant experience for long term holders. The last week also saw the share price slip down another 9.8%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

However if you'd rather see where the opportunities and risks are within L&TFH's industry, you can check out our analysis on the IN Diversified Financial industry.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

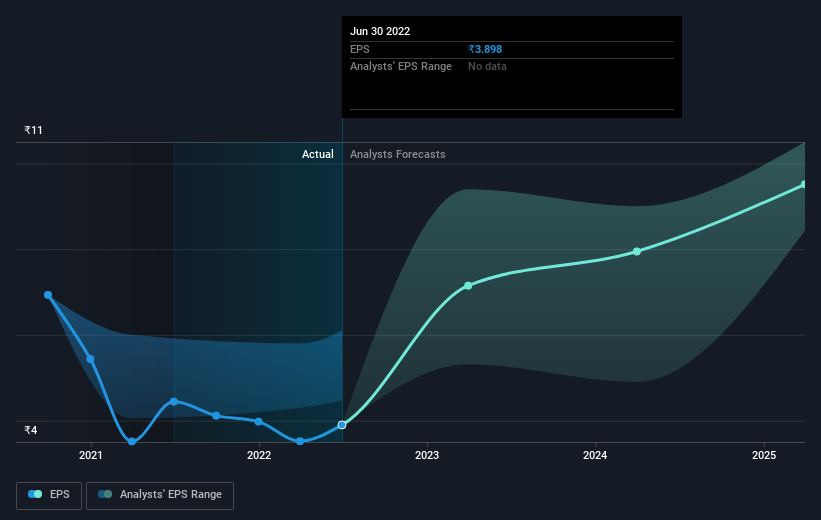

During the five years over which the share price declined, L&T Finance Holdings' earnings per share (EPS) dropped by 7.3% each year. This reduction in EPS is less than the 18% annual reduction in the share price. This implies that the market is more cautious about the business these days.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, L&T Finance Holdings' TSR for the last 5 years was -58%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Investors in L&T Finance Holdings had a tough year, with a total loss of 16% (including dividends), against a market gain of about 2.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for L&T Finance Holdings you should be aware of, and 1 of them doesn't sit too well with us.

Of course L&T Finance Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you're looking to trade L&T Finance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LTF

L&T Finance

A non-banking financial company, provides various financial products and services in India.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives