- India

- /

- Diversified Financial

- /

- NSEI:IRFC

Indian Railway Finance Corporation Limited's (NSE:IRFC) Shares Climb 67% But Its Business Is Yet to Catch Up

Despite an already strong run, Indian Railway Finance Corporation Limited (NSE:IRFC) shares have been powering on, with a gain of 67% in the last thirty days. This latest share price bounce rounds out a remarkable 442% gain over the last twelve months.

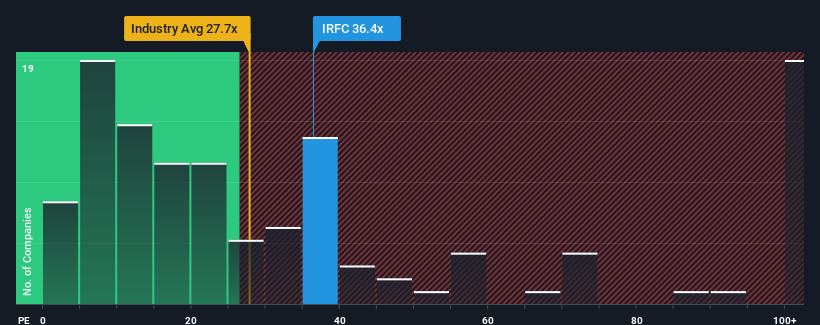

After such a large jump in price, Indian Railway Finance's price-to-earnings (or "P/E") ratio of 36.4x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 31x and even P/E's below 17x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Indian Railway Finance's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Indian Railway Finance

Is There Enough Growth For Indian Railway Finance?

The only time you'd be truly comfortable seeing a P/E as high as Indian Railway Finance's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 6.0%. Even so, admirably EPS has lifted 43% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it concerning that Indian Railway Finance is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Final Word

The large bounce in Indian Railway Finance's shares has lifted the company's P/E to a fairly high level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Indian Railway Finance currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Indian Railway Finance (1 is significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Indian Railway Finance, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IRFC

Indian Railway Finance

Engages in leasing of rolling stock assets, railway infrastructure assets in India.

Acceptable track record second-rate dividend payer.