- India

- /

- Capital Markets

- /

- NSEI:IIFLCAPS

Three Undiscovered Gems In India To Enhance Your Portfolio

Reviewed by Simply Wall St

In the last week, the Indian market has stayed flat, yet it is up 44% over the past year with earnings expected to grow by 17% per annum over the next few years. In such a dynamic environment, identifying stocks with strong growth potential and solid fundamentals can be key to enhancing your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| Bengal & Assam | 4.48% | 1.54% | 51.11% | ★★★★★☆ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Insolation Energy | 88.64% | 163.87% | 419.31% | ★★★★★☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

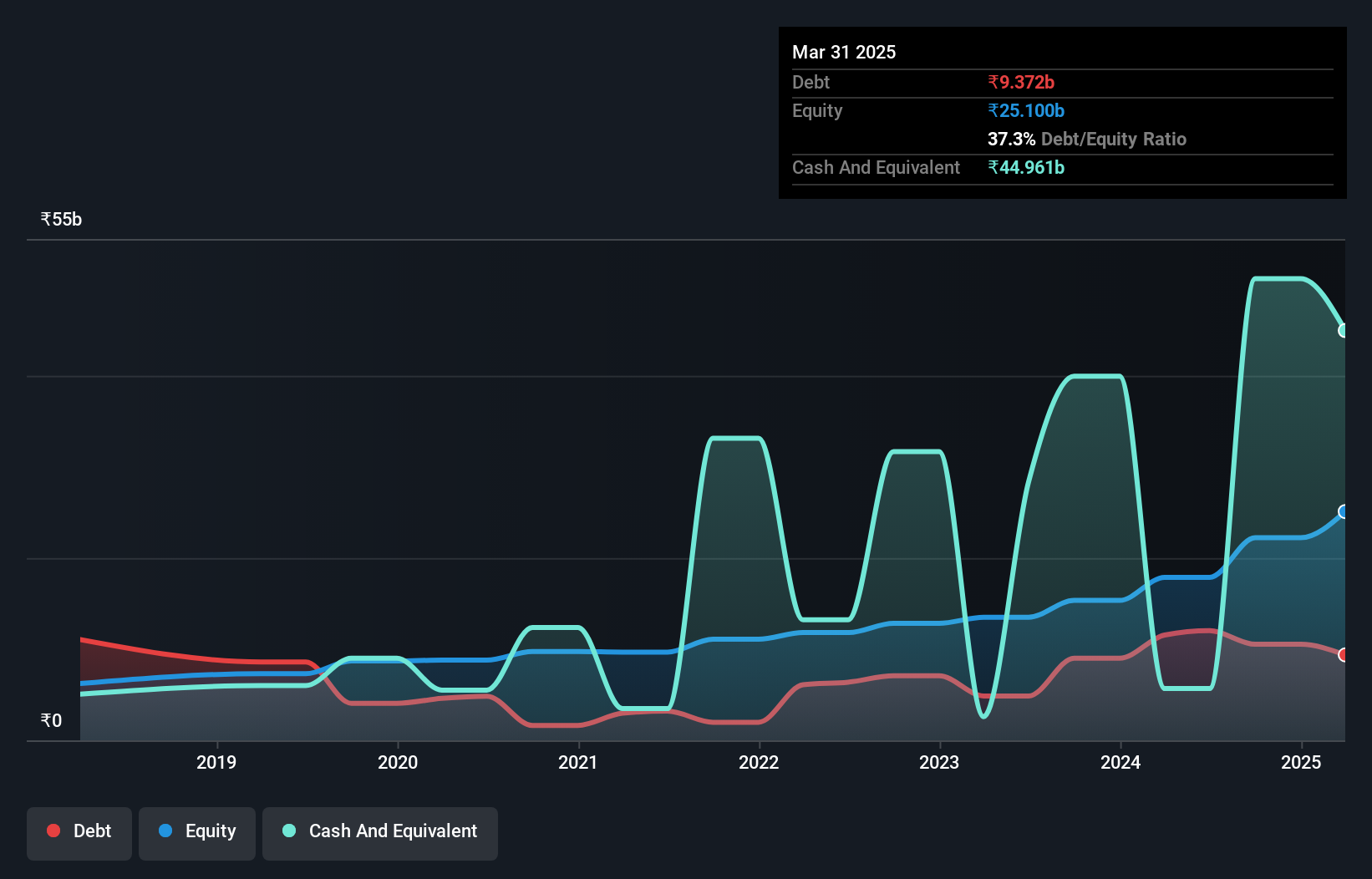

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets, with a market cap of ₹68.43 billion.

Operations: IIFL Securities Limited generates revenue primarily from capital market activities (₹20.25 billion), with additional income from facilities and ancillary services (₹375.25 million) and insurance broking and ancillary services (₹2.77 billion).

IIFL Securities, a notable player in India's financial sector, has shown impressive earnings growth of 120.4% over the past year, outpacing the industry average of 64%. The company's price-to-earnings ratio stands at an attractive 12.4x compared to the Indian market's 32.9x. Despite recent volatility in share price and a penalty from SEBI for technical errors, IIFLSEC's net debt to equity ratio is satisfactory at 35.5%, and its high-quality earnings underscore its potential as an investment gem.

- Get an in-depth perspective on IIFL Securities' performance by reading our health report here.

Evaluate IIFL Securities' historical performance by accessing our past performance report.

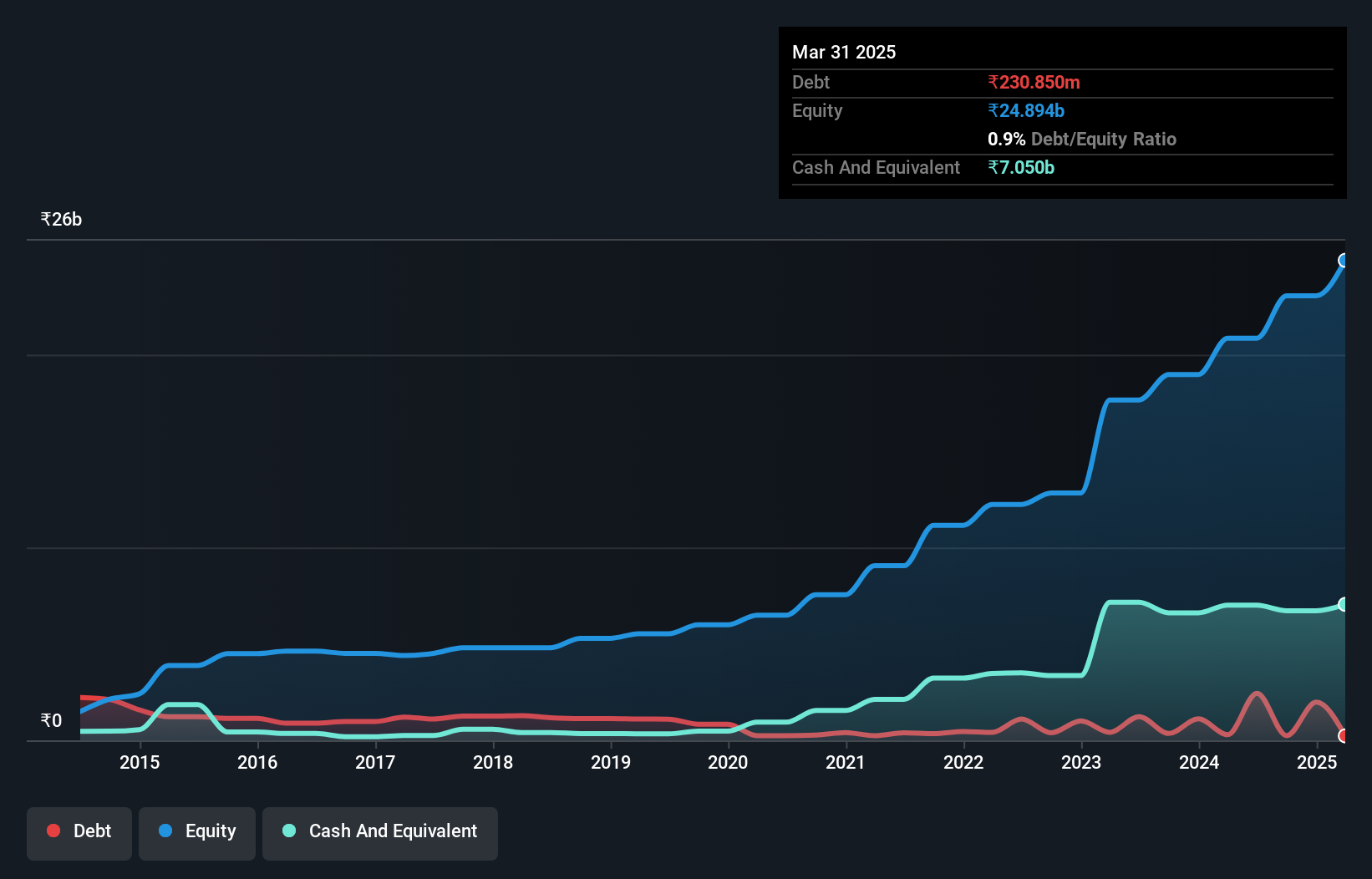

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research and development, manufacturing, marketing, and sale of generic pharmaceutical formulations globally and has a market cap of ₹99.76 billion.

Operations: Marksans Pharma Limited generates revenue primarily from its pharmaceutical segment, which amounted to ₹22.68 billion. The company has a market cap of ₹99.76 billion.

Marksans Pharma has shown impressive growth, with earnings increasing by 21.7% over the past year, outpacing the Pharmaceuticals industry’s 19.3%. The company’s debt to equity ratio improved from 19.9% to 11.7% in five years, reflecting prudent financial management. Recent quarterly results reported net income of ₹887.52 million compared to ₹686.58 million a year ago, and diluted EPS rose from ₹1.52 to ₹1.96 INR per share, indicating robust profitability and operational efficiency despite market volatility.

Zaggle Prepaid Ocean Services (NSEI:ZAGGLE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zaggle Prepaid Ocean Services Limited develops financial products and solutions to manage business expenses for corporates, small and medium-sized enterprises, and startups through automated workflows, with a market cap of ₹44.66 billion.

Operations: Zaggle generates revenue primarily from program fees (₹4.01 billion), Propel platform and gift card sales (₹4.76 billion), and platform/SaaS/service fees (₹326.27 million). The company has a market capitalization of ₹44.66 billion.

Zaggle Prepaid Ocean Services has demonstrated robust performance with earnings growth of 108.5% over the past year, outpacing the Software industry’s 28.6%. The company reported Q1 2025 revenue of ₹2.57 billion, up from ₹1.20 billion a year earlier, and net income rose to ₹167.34 million from ₹20.55 million in the same period last year. Zaggle's recent client agreements with Baroda BNP Paribas and PNB MetLife highlight its expanding customer base and service offerings.

- Dive into the specifics of Zaggle Prepaid Ocean Services here with our thorough health report.

Learn about Zaggle Prepaid Ocean Services' historical performance.

Turning Ideas Into Actions

- Investigate our full lineup of 460 Indian Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLCAPS

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>