- India

- /

- Capital Markets

- /

- NSEI:DOLATALGO

If You Like EPS Growth Then Check Out Dolat Algotech (NSE:DOLATALGO) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Dolat Algotech (NSE:DOLATALGO), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Dolat Algotech

How Fast Is Dolat Algotech Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Dolat Algotech has grown EPS by 58% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

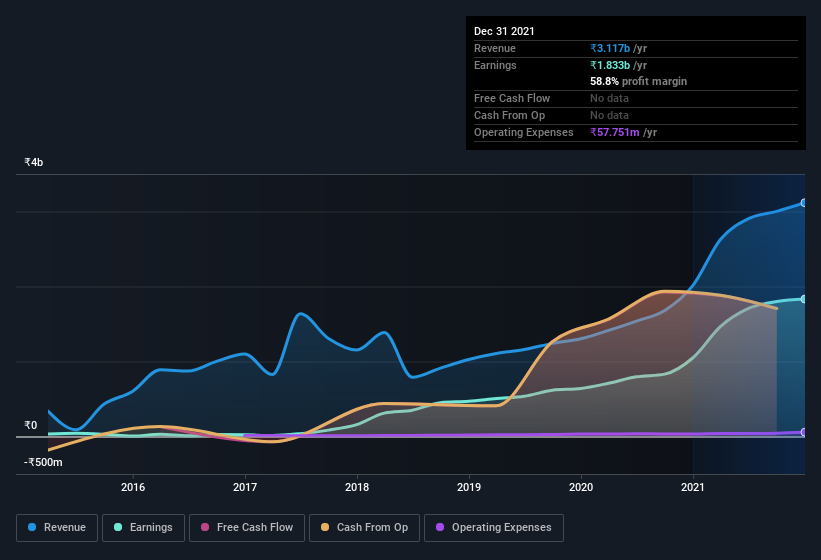

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Dolat Algotech's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Dolat Algotech maintained stable EBIT margins over the last year, all while growing revenue 55% to ₹3.1b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Dolat Algotech is no giant, with a market capitalization of ₹15b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Dolat Algotech Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Dolat Algotech shares worth a considerable sum. To be specific, they have ₹1.6b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 10% of the company; visible skin in the game.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between ₹7.6b and ₹30b, like Dolat Algotech, the median CEO pay is around ₹14m.

The Dolat Algotech CEO received total compensation of just ₹6.0m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Dolat Algotech Deserve A Spot On Your Watchlist?

Dolat Algotech's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so I do think Dolat Algotech is worth considering carefully. Now, you could try to make up your mind on Dolat Algotech by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DOLATALGO

Dolat Algotech

Engages in trading of shares, securities, commodities, and other financial products in India.

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives