- India

- /

- Diversified Financial

- /

- NSEI:CSLFINANCE

Should You Be Adding CSL Finance (NSE:CSLFINANCE) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like CSL Finance (NSE:CSLFINANCE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for CSL Finance

CSL Finance's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that CSL Finance's EPS has grown 23% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

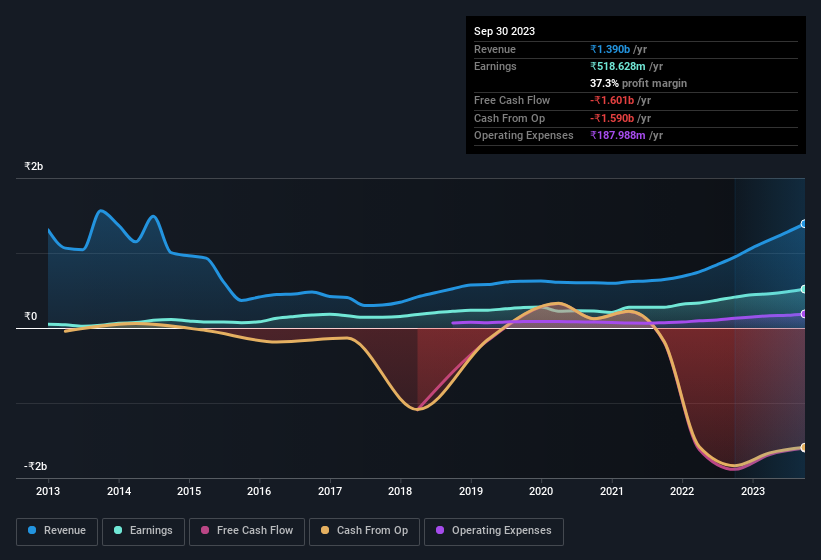

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that CSL Finance's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. CSL Finance maintained stable EBIT margins over the last year, all while growing revenue 47% to ₹1.4b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since CSL Finance is no giant, with a market capitalisation of ₹8.2b, you should definitely check its cash and debt before getting too excited about its prospects.

Are CSL Finance Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While CSL Finance insiders did net ₹1.1m selling stock over the last year, they invested ₹18m, a much higher figure. An optimistic sign for those with CSL Finance in their watchlist. It is also worth noting that it was Chief Operating Officer Amit Ranjan who made the biggest single purchase, worth ₹12m, paying ₹160 per share.

On top of the insider buying, it's good to see that CSL Finance insiders have a valuable investment in the business. Indeed, they hold ₹2.3b worth of its stock. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 29% of the shares on issue for the business, an appreciable amount considering the market cap.

Does CSL Finance Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into CSL Finance's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 5 warning signs for CSL Finance (2 don't sit too well with us) you should be aware of.

The good news is that CSL Finance is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CSLFINANCE

CSL Finance

A non-banking financial company, provides SME and wholesale loaning businesses in India.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.