- India

- /

- Consumer Finance

- /

- NSEI:CREDITACC

Potential Upside For CreditAccess Grameen Limited (NSE:CREDITACC) Not Without Risk

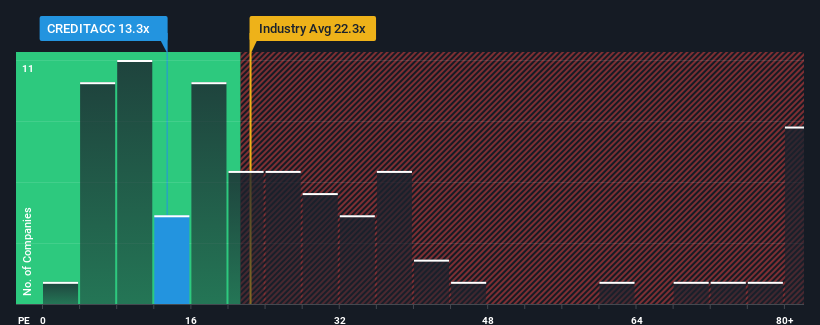

CreditAccess Grameen Limited's (NSE:CREDITACC) price-to-earnings (or "P/E") ratio of 13.3x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 35x and even P/E's above 66x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been advantageous for CreditAccess Grameen as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for CreditAccess Grameen

Is There Any Growth For CreditAccess Grameen?

There's an inherent assumption that a company should far underperform the market for P/E ratios like CreditAccess Grameen's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 44%. The latest three year period has also seen an excellent 1,595% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 18% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 20% each year, which is not materially different.

In light of this, it's peculiar that CreditAccess Grameen's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From CreditAccess Grameen's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of CreditAccess Grameen's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for CreditAccess Grameen (1 doesn't sit too well with us!) that you need to be mindful of.

Of course, you might also be able to find a better stock than CreditAccess Grameen. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CREDITACC

CreditAccess Grameen

A non-banking financial company, provides micro finance services for women from poor and low income households in India.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives