- India

- /

- Consumer Finance

- /

- NSEI:CREDITACC

If EPS Growth Is Important To You, CreditAccess Grameen (NSE:CREDITACC) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in CreditAccess Grameen (NSE:CREDITACC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for CreditAccess Grameen

CreditAccess Grameen's Improving Profits

CreditAccess Grameen has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, CreditAccess Grameen's EPS grew from ₹52.04 to ₹90.74, over the previous 12 months. Year on year growth of 74% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

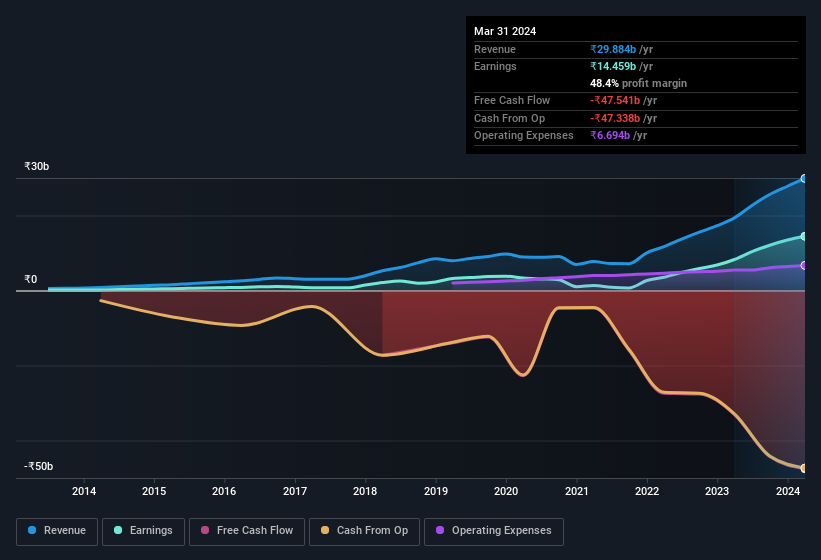

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that CreditAccess Grameen's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note CreditAccess Grameen achieved similar EBIT margins to last year, revenue grew by a solid 54% to ₹30b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for CreditAccess Grameen's future EPS 100% free.

Are CreditAccess Grameen Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that CreditAccess Grameen insiders have a significant amount of capital invested in the stock. To be specific, they have ₹2.8b worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 1.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like CreditAccess Grameen with market caps between ₹167b and ₹534b is about ₹46m.

The CreditAccess Grameen CEO received total compensation of just ₹20m in the year to March 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is CreditAccess Grameen Worth Keeping An Eye On?

CreditAccess Grameen's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that CreditAccess Grameen is worth considering carefully. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for CreditAccess Grameen that you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CREDITACC

CreditAccess Grameen

A non-banking financial company, provides micro finance services for women from poor and low income households in India.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives