- India

- /

- Consumer Finance

- /

- NSEI:ARMANFIN

Many Still Looking Away From Arman Financial Services Limited (NSE:ARMANFIN)

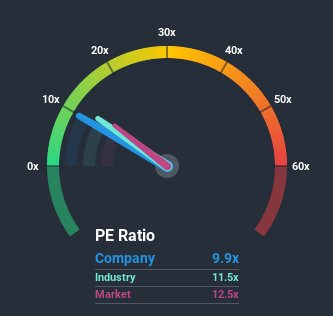

Arman Financial Services Limited's (NSE:ARMANFIN) price-to-earnings (or "P/E") ratio of 9.9x might make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 13x and even P/E's above 30x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been quite advantageous for Arman Financial Services as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Arman Financial Services

Where Does Arman Financial Services' P/E Sit Within Its Industry?

It's plausible that Arman Financial Services' low P/E ratio could be a result of tendencies within its own industry. It turns out the Consumer Finance industry in general has a P/E ratio similar to the market, as the graphic below shows. So we'd say there is little merit in the premise that the company's ratio being shaped by its industry at this time. Ordinarily, the majority of companies' P/E's would be supported by the general conditions within the Consumer Finance industry. Nevertheless, the company's P/E should be primarily influenced by its own financial performance.

Is There Any Growth For Arman Financial Services?

Arman Financial Services' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 81% gain to the company's bottom line. Pleasingly, EPS has also lifted 597% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to shrink 6.5% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's quite peculiar that Arman Financial Services' P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Arman Financial Services' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Arman Financial Services currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. We think potential risks might be placing significant pressure on the P/E ratio and share price. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. At least the risk of a price drop looks to be subdued, but investors think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Arman Financial Services (1 is a bit unpleasant!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you decide to trade Arman Financial Services, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ARMANFIN

Arman Financial Services

Together with its subsidiary, Namra Finance Limited, operates as a non-banking finance company in India.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives