- India

- /

- Hospitality

- /

- NSEI:THOMASCOOK

Thomas Cook (India) Limited's (NSE:THOMASCOOK) Shares Bounce 30% But Its Business Still Trails The Industry

Thomas Cook (India) Limited (NSE:THOMASCOOK) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. The last month tops off a massive increase of 196% in the last year.

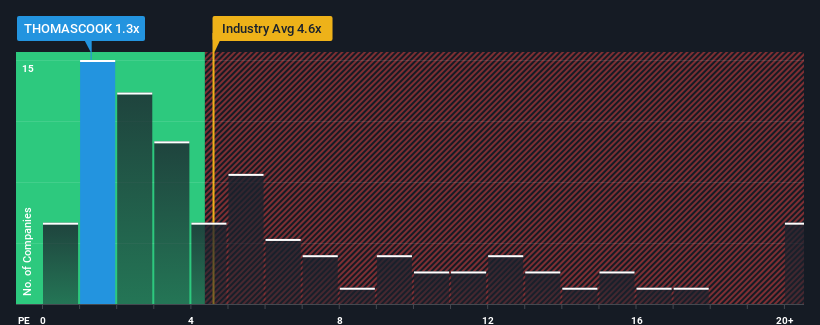

Although its price has surged higher, Thomas Cook (India) may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.3x, since almost half of all companies in the Hospitality industry in India have P/S ratios greater than 4.6x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Thomas Cook (India)

What Does Thomas Cook (India)'s P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Thomas Cook (India) has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Thomas Cook (India) will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Thomas Cook (India)?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Thomas Cook (India)'s to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 63%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 27% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Thomas Cook (India)'s P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Thomas Cook (India)'s P/S

Thomas Cook (India)'s recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Thomas Cook (India) maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Thomas Cook (India) with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Thomas Cook (India), explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Thomas Cook (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:THOMASCOOK

Thomas Cook (India)

Offers integrated travel services in India and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives