- India

- /

- Consumer Durables

- /

- NSEI:WHIRLPOOL

Whirlpool of India (NSE:WHIRLPOOL) Has Re-Affirmed Its Dividend Of ₹5.00

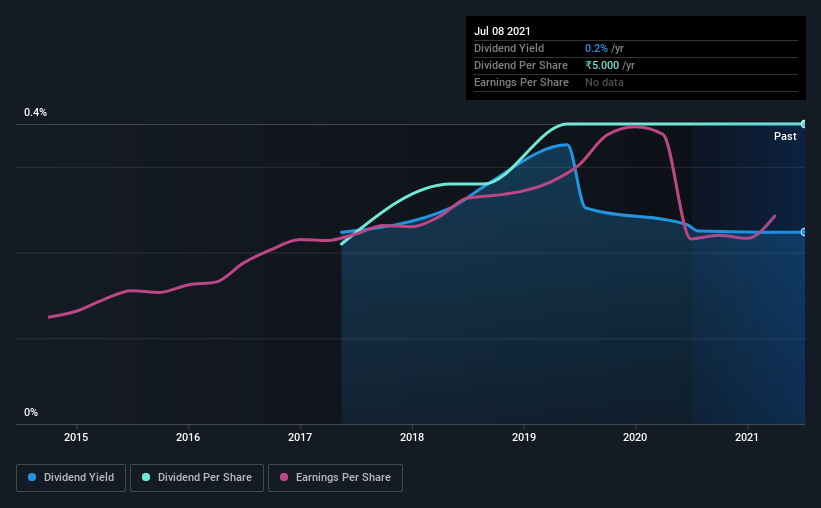

The board of Whirlpool of India Limited (NSE:WHIRLPOOL) has announced that it will pay a dividend of ₹5.00 per share on the 15th of September. This payment means the dividend yield will be 0.2%, which is below the average for the industry.

Check out our latest analysis for Whirlpool of India

Whirlpool of India's Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. However, Whirlpool of India's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

If the trend of the last few years continues, EPS will grow by 7.9% over the next 12 months. If the dividend continues on this path, the payout ratio could be 19% by next year, which we think can be pretty sustainable going forward.

Whirlpool of India Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The dividend has gone from ₹3.00 in 2017 to the most recent annual payment of ₹5.00. This means that it has been growing its distributions at 14% per annum over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

We Could See Whirlpool of India's Dividend Growing

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. It's encouraging to see Whirlpool of India has been growing its earnings per share at 7.9% a year over the past five years. Whirlpool of India definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

Our Thoughts On Whirlpool of India's Dividend

Overall, a consistent dividend is a good thing, and we think that Whirlpool of India has the ability to continue this into the future. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. See if management have their own wealth at stake, by checking insider shareholdings in Whirlpool of India stock. We have also put together a list of global stocks with a solid dividend.

If you decide to trade Whirlpool of India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool of India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:WHIRLPOOL

Whirlpool of India

Manufactures and markets home appliances in India and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives