United Polyfab Gujarat Limited (NSE:UNITEDPOLY) Looks Just Right With A 29% Price Jump

United Polyfab Gujarat Limited (NSE:UNITEDPOLY) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

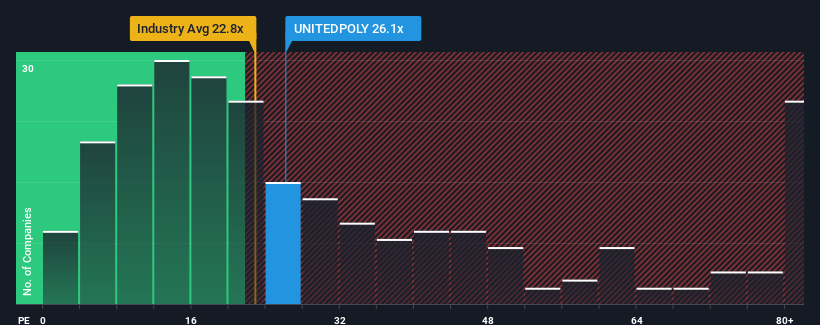

Even after such a large jump in price, there still wouldn't be many who think United Polyfab Gujarat's price-to-earnings (or "P/E") ratio of 26.1x is worth a mention when the median P/E in India is similar at about 26x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, United Polyfab Gujarat has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for United Polyfab Gujarat

Is There Some Growth For United Polyfab Gujarat?

In order to justify its P/E ratio, United Polyfab Gujarat would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 62% gain to the company's bottom line. Pleasingly, EPS has also lifted 106% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's about the same on an annualised basis.

With this information, we can see why United Polyfab Gujarat is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

United Polyfab Gujarat's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that United Polyfab Gujarat maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider and we've discovered 2 warning signs for United Polyfab Gujarat (1 is a bit concerning!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UNITEDPOLY

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives