The MD & Whole Time Director of T.T. Limited (NSE:TTL), Sanjay Jain, Just Bought 1.7% More Shares

Even if it's not a huge purchase, we think it was good to see that Sanjay Jain, the MD & Whole Time Director of T.T. Limited (NSE:TTL) recently shelled out ₹423k to buy stock, at ₹48.10 per share. Although the purchase is not a big one, increasing their shareholding by only 1.7%, it can be interpreted as a good sign.

See our latest analysis for T.T

T.T Insider Transactions Over The Last Year

While no particular insider transaction stood out, we can still look at the overall trading.

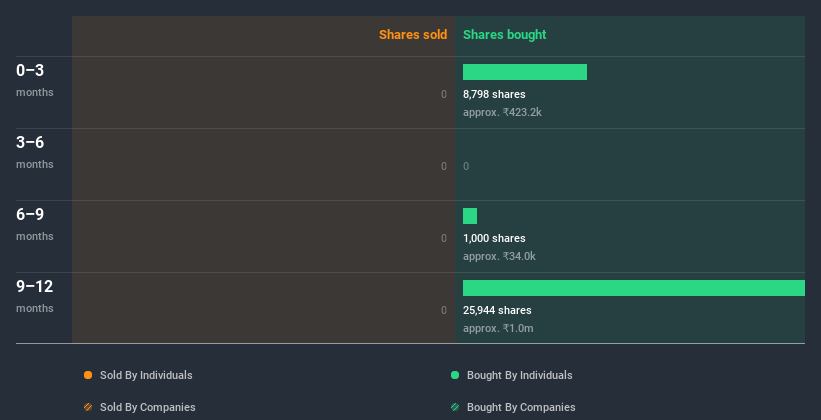

While T.T insiders bought shares during the last year, they didn't sell. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

T.T is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership of T.T

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. T.T insiders own about ₹589m worth of shares (which is 63% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About T.T Insiders?

The recent insider purchase is heartening. And an analysis of the transactions over the last year also gives us confidence. But we don't feel the same about the fact the company is making losses. Once you factor in the high insider ownership, it certainly seems like insiders are positive about T.T. One for the watchlist, at least! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For example, T.T has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading T.T or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if T.T might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TTL

T.T

Engages in the manufacture and sale of textile products in India and Vietnam.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)