Improved Earnings Required Before The Ruby Mills Limited (NSE:RUBYMILLS) Stock's 26% Jump Looks Justified

The Ruby Mills Limited (NSE:RUBYMILLS) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

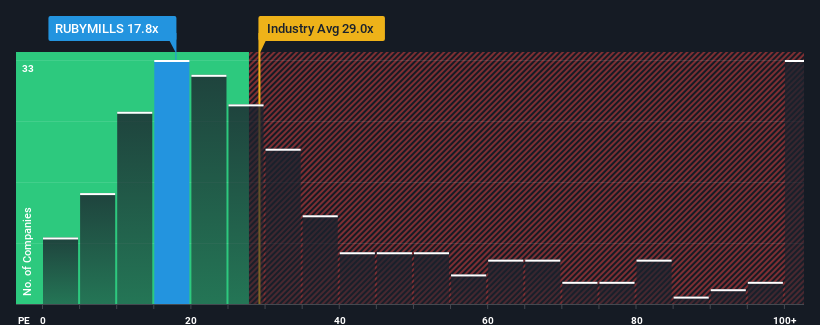

In spite of the firm bounce in price, Ruby Mills may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 17.8x, since almost half of all companies in India have P/E ratios greater than 35x and even P/E's higher than 67x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at Ruby Mills over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Ruby Mills

Does Growth Match The Low P/E?

Ruby Mills' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 26%. Pleasingly, EPS has also lifted 73% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Ruby Mills is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Ruby Mills' P/E

Ruby Mills' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Ruby Mills revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Ruby Mills that you should be aware of.

Of course, you might also be able to find a better stock than Ruby Mills. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RUBYMILLS

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives