Relaxo Footwears Limited's (NSE:RELAXO) Price Is Out Of Tune With Revenues

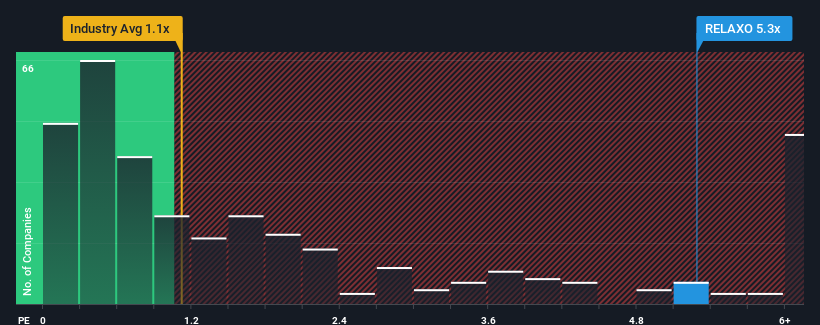

Relaxo Footwears Limited's (NSE:RELAXO) price-to-sales (or "P/S") ratio of 5.3x may look like a poor investment opportunity when you consider close to half the companies in the Luxury industry in India have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Relaxo Footwears

What Does Relaxo Footwears' P/S Mean For Shareholders?

Relaxo Footwears could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Relaxo Footwears will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Relaxo Footwears?

The only time you'd be truly comfortable seeing a P/S as steep as Relaxo Footwears' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 9.8% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 11% over the next year. That's shaping up to be materially lower than the 24% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Relaxo Footwears' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Relaxo Footwears trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Relaxo Footwears that you should be aware of.

If these risks are making you reconsider your opinion on Relaxo Footwears, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RELAXO

Relaxo Footwears

Engages in the manufacture and sale of footwear for men, women, and kids in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives