- India

- /

- Consumer Durables

- /

- NSEI:PRITI

Here's Why We Think Priti International (NSE:PRITI) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Priti International (NSE:PRITI). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Priti International with the means to add long-term value to shareholders.

View our latest analysis for Priti International

Priti International's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Priti International's EPS has grown 25% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Priti International is growing revenues, and EBIT margins improved by 2.1 percentage points to 11%, over the last year. Both of which are great metrics to check off for potential growth.

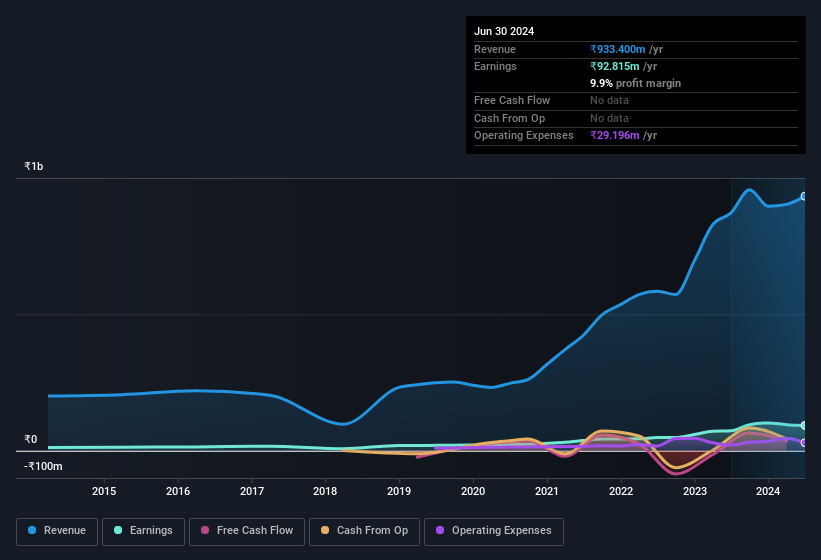

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Priti International is no giant, with a market capitalisation of ₹1.8b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Priti International Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Priti International shares, in the last year. So it's definitely nice that Chairman & Vigil Mechanism Officer Goverdhan Lohiya bought ₹1.2m worth of shares at an average price of around ₹232. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Priti International.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Priti International will reveal that insiders own a significant piece of the pie. In fact, they own 64% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Although, with Priti International being valued at ₹1.8b, this is a small company we're talking about. That means insiders only have ₹1.2b worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

Should You Add Priti International To Your Watchlist?

You can't deny that Priti International has grown its earnings per share at a very impressive rate. That's attractive. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. So it's fair to say that this stock may well deserve a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Priti International , and understanding these should be part of your investment process.

The good news is that Priti International is not the only stock with insider buying. Here's a list of small cap, undervalued companies in IN with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRITI

Priti International

Engages in the manufacture, sale, and export of wooden, metal, and textile based furniture and handicraft products in India.

Excellent balance sheet with low risk.

Market Insights

Community Narratives